Warren Buffett Portfolio Analysis 2025

Article last updated: August 1, 2025

Warren Buffett: The Oracle of Omaha

Warren Buffett is more than an investor; he's an icon. For decades, his name has been synonymous with "buy-and-hold" wisdom and market-beating returns. But in an era of unprecedented market volatility and technological disruption, does the Oracle of Omaha's strategy still hold up?

We decided to look past the headlines and annual letters. By loading over a decade of Berkshire Hathaway's publicly available 13F data into the Portseido portfolio tracker, we can see what the raw numbers reveal about his performance, his biggest bets, and his trading habits. The results are fascinatng.

Here is Portseido's Legend Under the Lens Ep1: Warren Buffett (Video)

For a visual breakdown and additional insights, check out our YouTube video on Warren Buffett's portfolio analysis:

Disclaimer: This analysis is based on publicly available 13F data from 2013-2025. Trade dates and prices are estimated at quarter-end. The analysis excludes Berkshire Hathaway's large cash holdings to focus specifically on the performance of its equity portfolio. TWR return calculation method is used in this analysis.

The Big Picture: Performance and Resilience

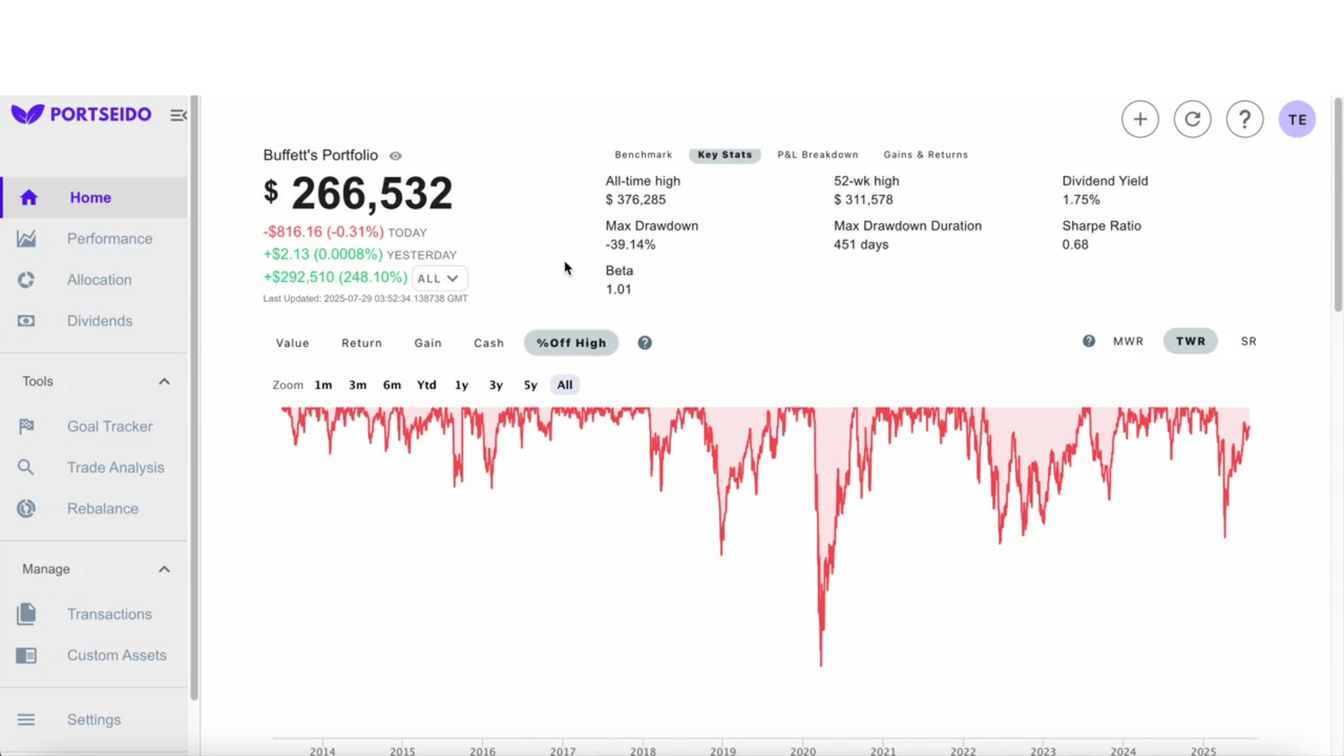

At first glance, the growth is undeniable. The portfolio has demonstrated a steady, powerful climb over the last decade, transforming into a behemoth valued at over $266 billion.

But this chart also tells a story of resilience. No investor, not even Buffett, is immune to market shocks. The sharp dip in early 2020 shows how the portfolio weathered the COVID-19 crash.

Then we can look further at the key stats.

With a Beta of 1.01, the portfolio's volatility almost perfectly mirrors the broader market. The most telling metric here is the Max Drawdown of -39.14%. While a significant drop, the crucial lesson is in the Drawdown Duration: 451 days. It took over a year of discipline and conviction to recover from that market bottom—a powerful reminder that long-term investing requires extraordinary patience.

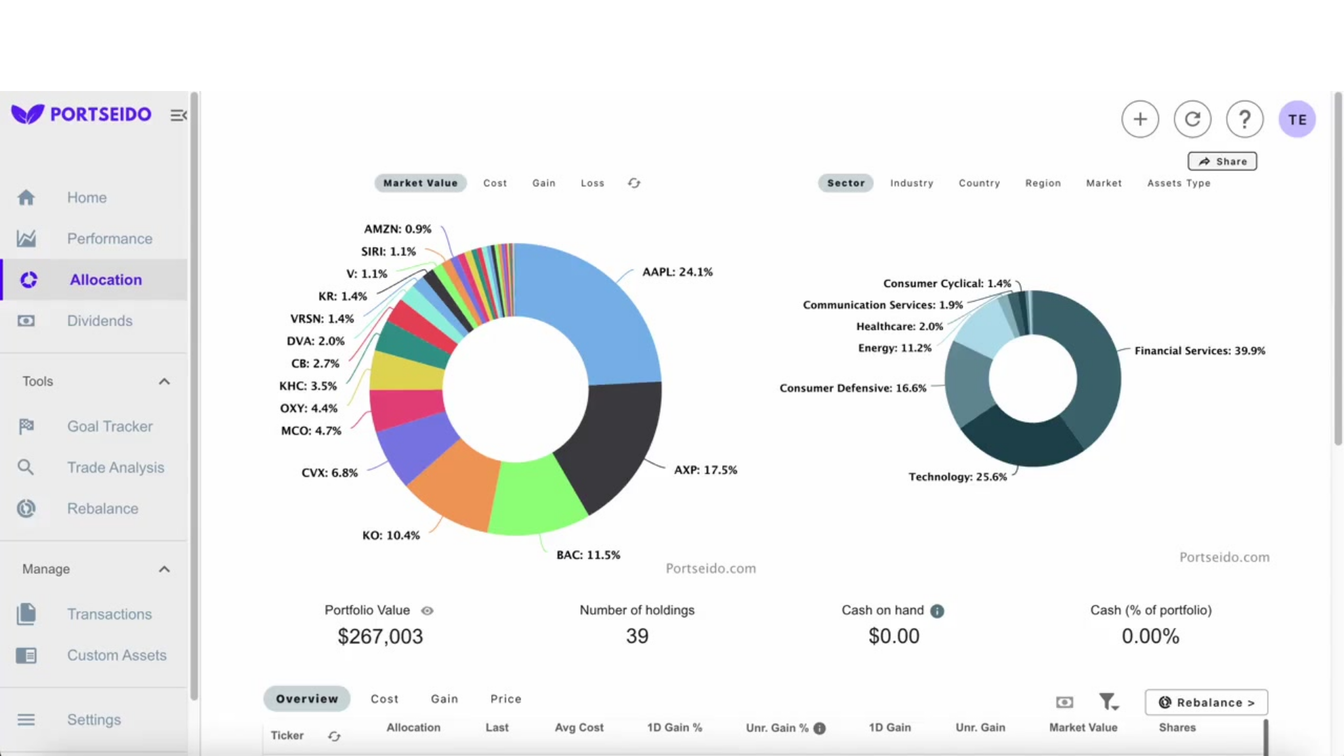

Portfolio Allocation: A Masterclass in High-Conviction Betting

So, what fuels this engine? The answer is concentration.

The portfolio holds 39 different assets. The followings are his top 10 holdings:

- Apple (AAPL): 24.1%

- American Express (AXP): 17.5%

- Bank of America (BAC): 11.5%

- Coca-Cola Co (KO): 10.4%

- Chevron Corp (CVX): 6.8%

- Moody's Corp (MCO): 4.7%

- Occidental Petroleum Corp (OXY): 4.4%

- Kraft Heinz Co (KHC): 3.5%

- Chubb Ltd (CB): 2.7%

- Davita Inc (DVA): 2.0%

The top three positions alone account for more than half of the entire equity portfolio. While the top 10 positions acount for 87.6% of his portfolio. This isn't diversification in the traditional sense; it's a powerful display of conviction in a select few businesses. On diversification, Buffett and Munger even stated "Three wonderful businesses will be better than a hundred average businesses."

From a sector perspective, this translates to a massive bet on two areas of the economy: Financial Services (39.9%) and Technology (25.6%).

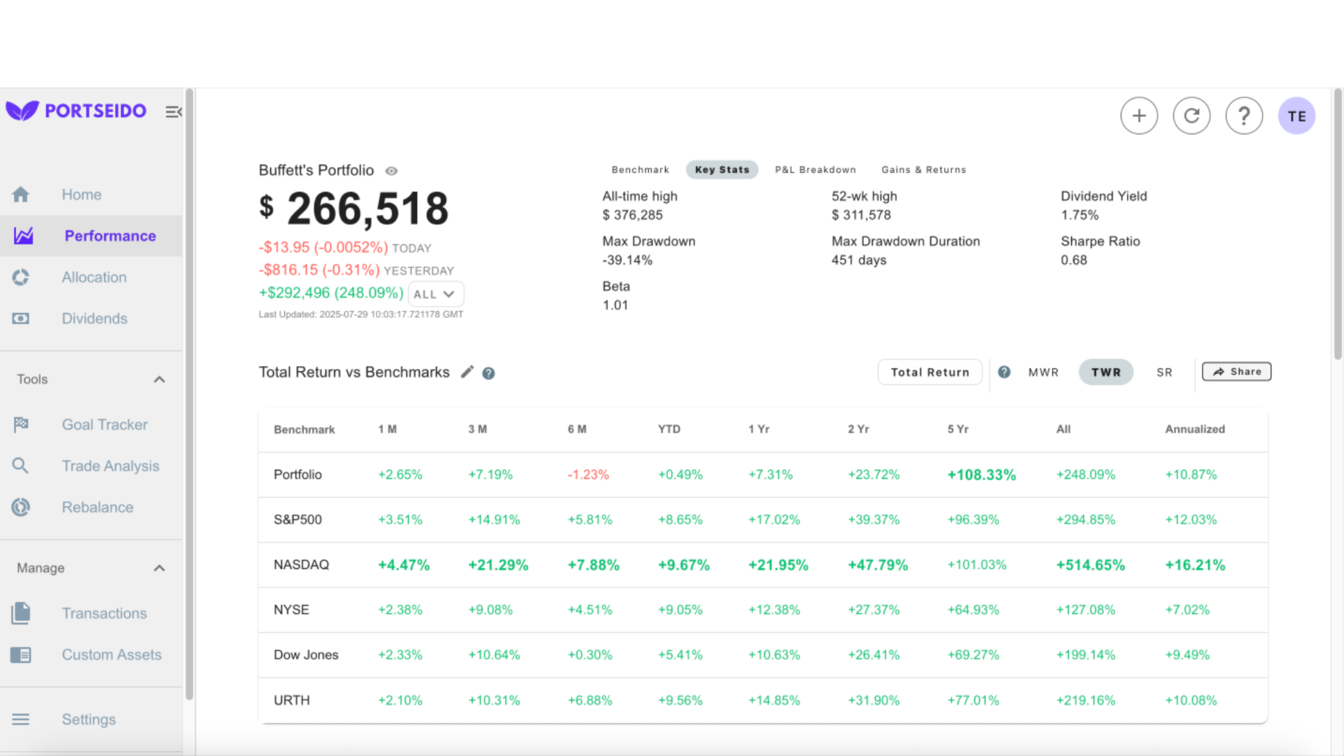

The Ultimate Showdown: Buffett vs. The S&P 500

This is the question every investor wants answered: does Buffett still beat the market? The data gives us a nuanced answer.

Over the entire tracking period since 2013, Buffett's annualized return is an impressive 10.87%. However, the S&P 500 actually edged it out with a 12.03% return. This shows that over certain long-term periods, a simple index fund can outperform even the world's greatest stock picker.

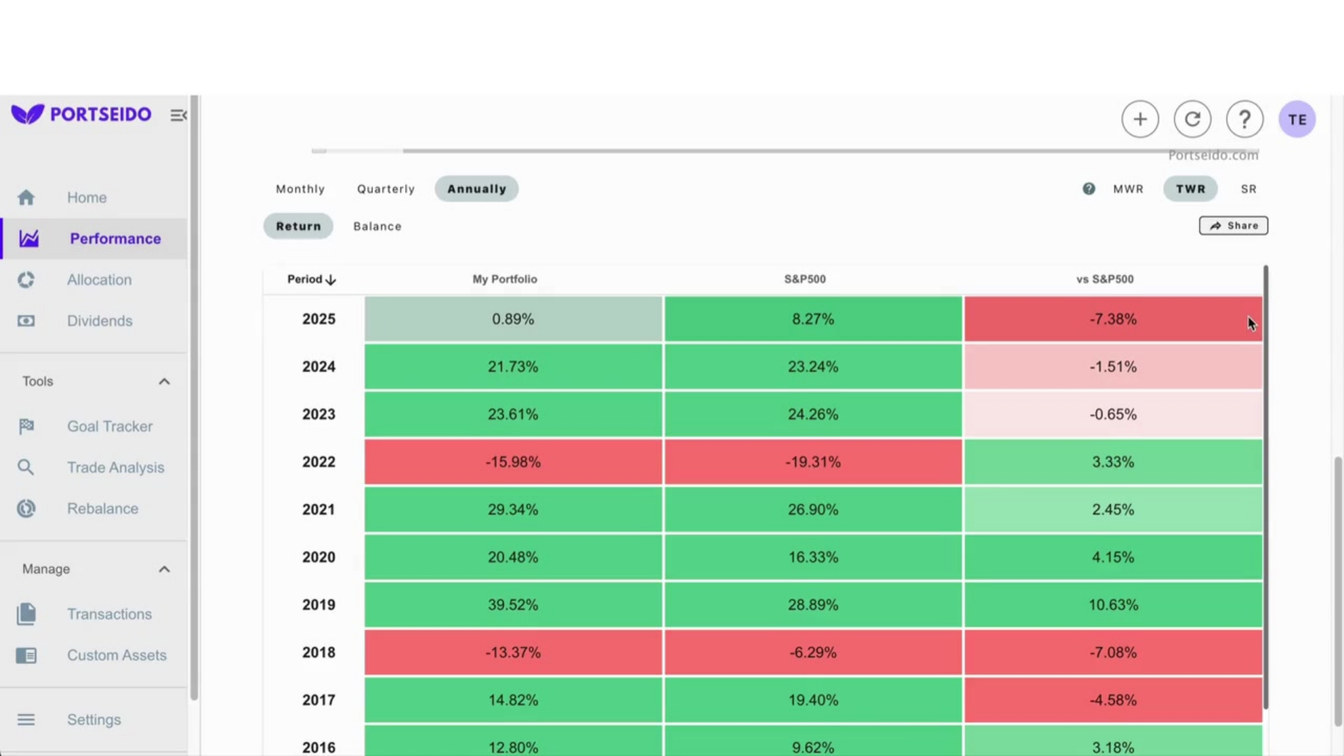

However, the story changes when we zoom in. A year-by-year breakdown reveals the ebb and flow of active management.

In some years, like 2019, Buffett's portfolio crushed the market by over 10 percentage points. In other years, it has lagged. This granular view demonstrates that outperformance isn't a constant, but a cyclical battle won over different market regimes.

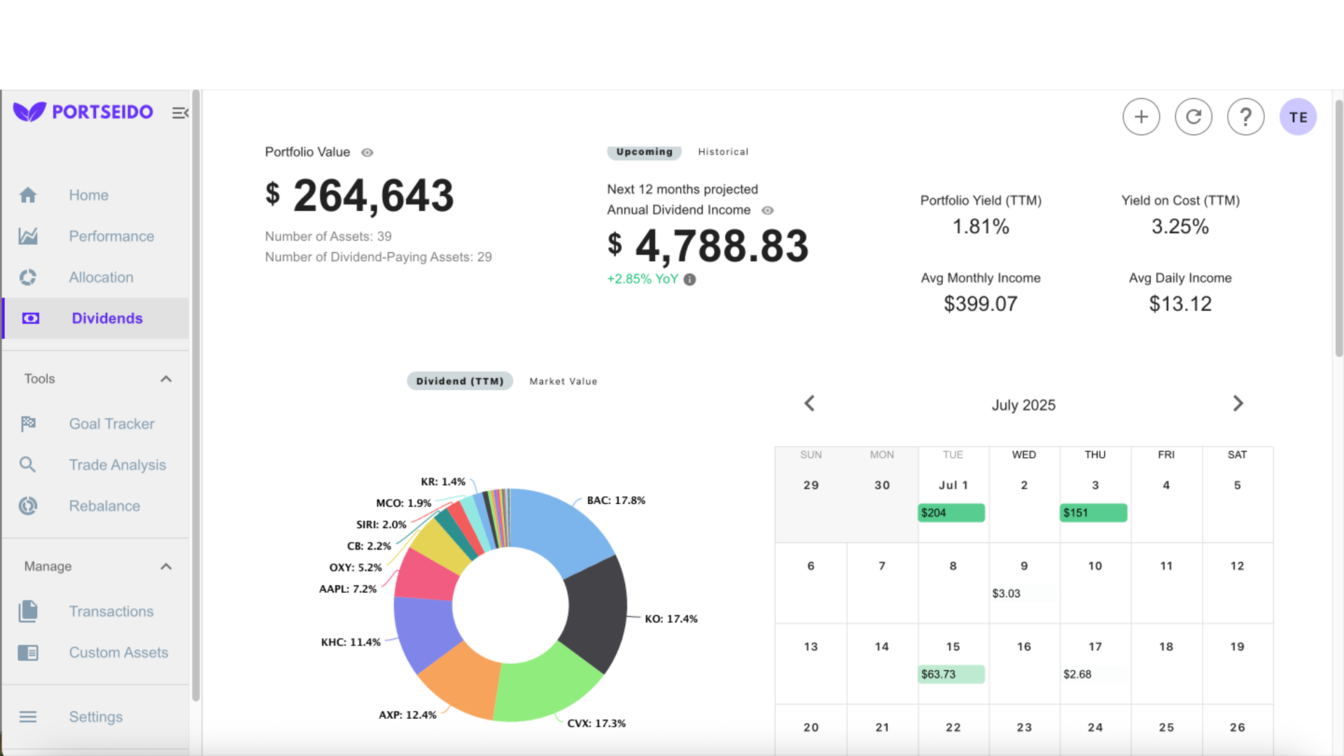

The Dividend Machine: Buffett's Secret Weapon

A significant part of Buffett's strategy is his focus on companies that generate and return cash to shareholders. His portfolio is a true dividend powerhouse as 29 out of 39 are dividend-paying stocks.

The portfolio is projected to generate nearly $4.8 billion in annual dividend income. But the most powerful metric for long-term investors is the Yield on Cost (YOC) of 3.25%. This is significantly higher than the portfolio's current dividend yield of 1.81%. It means that based on his original purchase price, Buffett is earning a much higher cash return than new investors buying the same stocks today—a perfect illustration of the rewards of buying and holding quality dividend-paying companies.

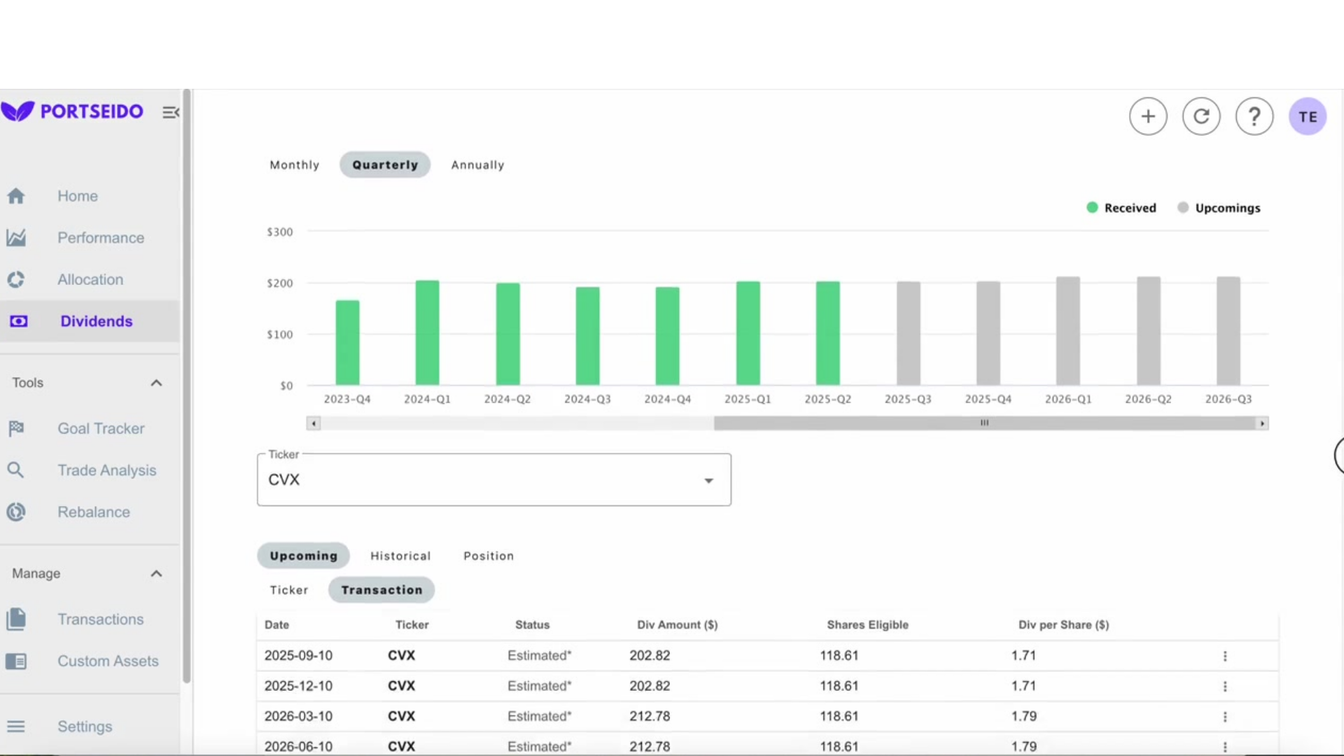

Drilling down into a specific holding like Chevron (CVX) shows a consistent payment of around $200 million every quarter.

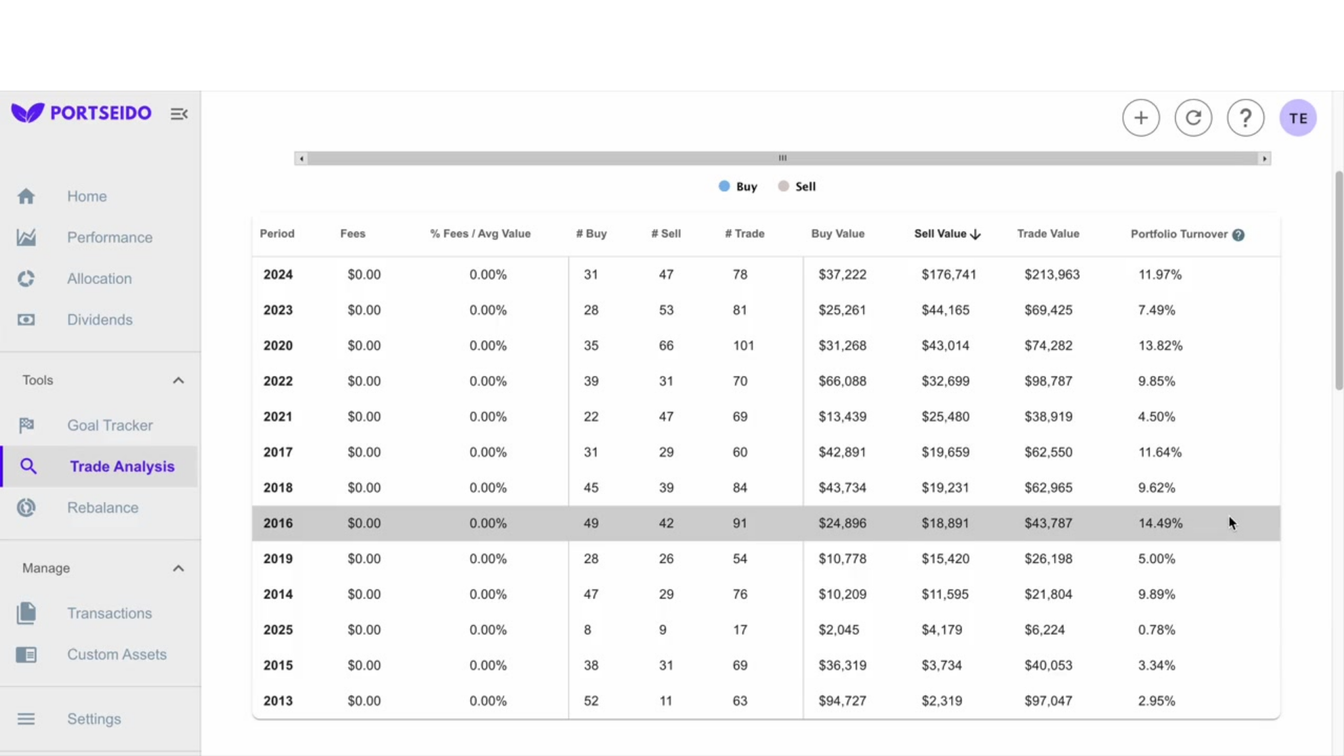

Trade Analysis: Debunking the "Buy and Forget" Myth

Is Buffett a "set it and forget it" investor? The data suggests he's far more active than his reputation suggests.

The chart above shows his trading activity over the years. During the market chaos of 2020, he made 101 total trades, his most active year in this period. In 2024, his firm sold a staggering $176 billion worth of stock, showing a clear pattern of trimming positions and reducing equity exposure.

Despite this activity, his Portfolio Turnover remains low, hovering around 14% even in its most active year. This confirms he isn't a trader, but he is constantly optimizing and fine-tuning his positions—a crucial distinction.

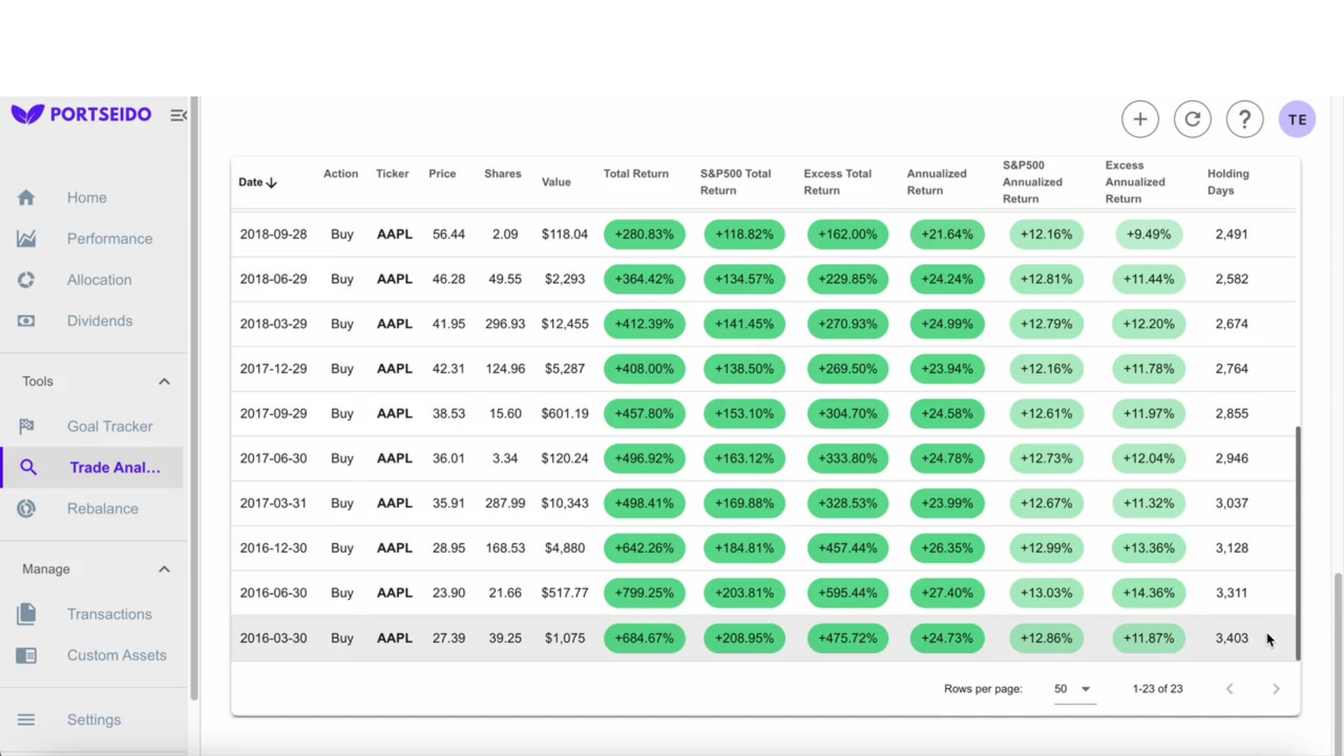

Uncovering True Alpha: Where the Magic Happens

The ultimate test of an active manager is their ability to generate returns above and beyond the market. By analyzing every closed trade, we can see exactly where Buffett's decisions created true alpha.

The legendary investment in Apple (AAPL) is the perfect case study. For one of his earliest purchases in 2016, the position returned +684%. During that same holding period, the S&P 500 returned +208%. That +475% of excess return is pure alpha—the result of a brilliant decision at the right time. This analysis proves that while he may not beat the market every single year, his big wins are monumental.

Conclusion: Lessons from the Oracle's Dashboard

Analyzing Warren Buffett's portfolio through a data-driven lens reveals three key lessons for all investors:

- Conviction is Key: Meaningful returns come from concentrated bets in businesses you understand deeply, not from owning a little bit of everything.

- Patience is a Superpower: The ability to withstand significant drawdowns and multi-year periods of underperformance is essential for long-term success.

- Great Investing is Active: "Buy and hold" doesn't mean "buy and forget." The best investors are constantly learning, evaluating, and optimizing their positions based on price and value.

While we may not have the billions that Buffett does, the principles that drive his success—discipline, conviction, and a relentless focus on business quality—are lessons we can all apply to our own financial journeys.

Frequently Asked Questions (FAQ)

What is Warren Buffett's portfolio performance in 2025?

As of August 2025, Warren Buffett's Berkshire Hathaway equity portfolio achieved an annualized return of 10.87% from 2013 to 2025, according to Portseido's analysis. However, the S&P 500 slightly outperformed with a 12.03% return over the same period.

What are the top holdings in Warren Buffett's portfolio?

As of August 2025, the top ten holdings are:

- Apple (AAPL): 24.1%

- American Express (AXP): 17.5%

- Bank of America (BAC): 11.5%

- Coca-Cola Co (KO): 10.4%

- Chevron Corp (CVX): 6.8%

- Moody's Corp (MCO): 4.7%

- Occidental Petroleum Corp (OXY): 4.4%

- Kraft Heinz Co (KHC): 3.5%

- Chubb Ltd (CB): 2.7%

- Davita Inc (DVA): 2.0%

Top three stocks make up more than half of the portfolio's value, and these ten stocks account for 87.6% of his portfolio.

How much dividend income does Buffett's portfolio generate?

As of August 2025, the portfolio is projected to generate nearly $4.8 billion in annual dividend income, with a yield on cost (YOC) of 3.25%.

Does Warren Buffett still beat the S&P 500?

As of August 2025, over the last decade, the S&P 500 has slightly outperformed Buffett's portfolio, but Buffett has had years of significant outperformance, especially in certain market regimes.

What can investors learn from Warren Buffett's strategy?

Key lessons include the importance of conviction, patience, and active portfolio management. Buffett's success is driven by concentrated bets, the ability to withstand drawdowns, and continuous evaluation of his holdings.

Ready to track your own portfolio like Buffett? Portseido is your secret weapon. Try it for free!

Happy Investing!