How many stocks should you own?

Article last updated: November 3, 2023

How Many Different Stocks Should You Own in Your Portfolio?

When it comes to building your investment portfolio, the age-old question remains: "how many stocks should I own?" There is no one-size-fits-all answer, as the ideal number of stocks can vary depending on your investment perspective and strategy. So, in this article, we explore this question from both theoretical and practical points of view from the most successful investors.

Theory Point of View:

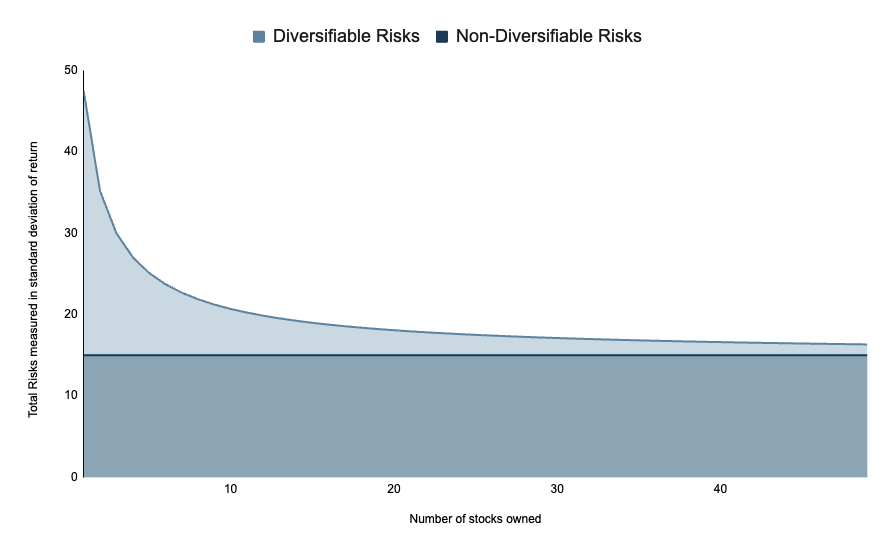

The short answer that many suggest is 20-30 stocks. However, for a long answer, we need to dive further into the theory. From a theoretical standpoint, the concept of diversification plays a pivotal role in determining the number of stocks in your portfolio. Diversification aims to mitigate risks, and it distinguishes between two types of risks:

Diversifiable Risks (Unsystematic Risks)

These are the risks associated with individual stocks or specific companies for example poor management decisions, industry-specific events, or company-specific issues. Diversification is an effective strategy for reducing diversifiable risks. By holding a diversified portfolio, you can reduce the impact of these events affecting a single company. Diversification is designed to smooth out these risks because not all of your investments will be affected in the same way or at the same time.

Non-Diversifiable Risks (Systematic Risks)

Non-diversifiable risks are systematic risks that affect the entire market or a broad sector of it, for example economic factors, interest rate changes, political events, and market sentiment. Non-diversifiable risks are typically measured by the beta of a stock, which quantifies how sensitive it is to market movements. These risks affect all investments to some degree and cannot be eliminated by merely adding more stocks to your portfolio.

The more stocks you add to your portfolio, the greater the diversification, leading to a reduction in overall risk. However, it's essential to note that as you keep adding more stocks, the incremental impact on risk reduction diminishes. So this makes many suggest that 20-30 stocks are the range that is optimal. For further reading, we would suggest a research from NDVR where they quantify risks and show how the number works out.

According to Most Successful Investors:

Many successful investors suggest that the ideal number of stocks in your portfolio depends on several factors, making it a more nuanced decision.

Competency

Warren Buffett, one of the most renowned investors of all time, emphasizes the importance of investing in what you understand. While he prefers holding a relatively small number of stocks in his portfolio to keep it concentrated, he acknowledges that not everyone is comfortable or competent in analyzing individual businesses. For those who lack the expertise or inclination for in-depth analysis, owning a broad market index, essentially owning everything, can be a prudent strategy. Similarly, Charlie Munger, Buffett's long-time business partner, has stated that investing in three outstanding opportunities is sufficient if you truly comprehend what you are doing.

Opportunities

Another key factor in determining the number of stocks you should own is the quality of investment opportunities you discover. Legendary investors like Peter Lynch and Warren Buffett both advocate investing heavily in the best opportunities available. Buffett famously said, "To have a super wonderful business and then put money into number 30 or 35 on your list of attractiveness and forgo putting more money into number one just strikes me and Charlie as Madness." Peter Lynch echoes this sentiment, suggesting that if you find ten equally attractive investment opportunities, you should consider investing in all of them. This approach aligns with the belief that owning only the best opportunities makes sense, even if they are few and far between.

Resources and Time

Consider the resources, particularly time, at your disposal for managing your investments. Researching and monitoring businesses in your portfolio requires a significant time commitment. The more positions you have, the more time and effort you need to allocate. This can potentially result in less in-depth research per investment. So, the number of stocks you own should also depend on your available time and your willingness to dedicate it to your investments.

In summary, there is no one best answer to the question of how many stocks you should own. Your decision should take into account your level of competency, the quality of investment opportunities you identify, and the time and resources you can commit to managing your portfolio. Whether you opt for a concentrated approach or a diversified one, what matters most is aligning your investment strategy with your goals and risk tolerance.

Track All Your Investments with Portseido

We know tracking your portfolios can be painful and high-effort, so we make it easy for you. Portseido helps you track all your investments easily and effortlessly with in-depth analytics on your allocation, powerful performance reports, and beautiful portfolio visualization, giving you a complete overview of your investments.

Sources: