Investing and the game of chance

Article last updated: July 12, 2022

Investing and trading are games of chance, unlike chess and other deterministic games, which means there is a random element involved in the game. This can be frustrating, but it is still the reality. Although you make the right decisions, it can still turn out wrong in the end by chance. So what should a player do in this case then? In this article, we break up each component of this game to try to understand it more and see how we can factor in these strategies in investing.

If you find this article helpful, don’t forget to share it with your fellow investors. If you also think that tracking your portfolio performance is useful and want to track it regularly and effortlessly, visit us at Portseido.

Flipping a coin

We demonstrate this with the simplest game, flipping a coin. In this game, given a coin with a known chance of landing heads or tails, the player will have to decide whether to bet on it or not. If the coin lands heads, the player will win some money. On the other hand, the player will lose some should the coin land tails. In this game, the only work that the player needs to do is assess whether the given probability and payout are on the player’s side or not. For example,

Coin with 50% chance to land heads and 50% chance to land tails

* Land Heads => Player wins $ 10

* Land Tails => Player loses $ 10

In this case, it’s a fair game which means, on average, players gain nothing from betting on it. Of course, if you toss the coin one time, you will either win $ 10 or lose $ 10. However, if you toss it enough times, the profit will likely head toward $ 0 on average.

Another example is

Coin with 51% chance to land heads and 49% chance to land tails

* Land Heads => Player wins $ 10

* Land Tails => Player loses $ 10

In this case, it’s an unfair game which benefits the player. The chance that you will be at profit after 100 tosses has now jumped from 0.46 in the last case to 0.54.

Another example is

Coin with 50% chance to land heads and 50% chance to land tails

* Land Heads => Player wins $ 10

* Land Tails => Player loses $ 15

In this case too, it’s an unfair game but now it worsens the odds for the player to be profitable in the long term. The chance that you will be at profit after 100 tosses has now reduced to 0.02.

As you can see, there are only 2 components in this game which are Outcomes (amount of money you will receive and pay) and Probability of each outcome. The way to play this game is quite straightforward. We just play the game every time the expected outcome is greater than 0.

The characteristics of such game are:

- High chance of winning, low chance of losing

- High prize when we win, low penalty when we lose

Many times we need just one of the statements to be true. For example, the coin (investment) might have a low chance of winning, but, when we win, we win big, and, when we lose, we lose by not so much. If the gap is big enough, it can offset the fact that it has a low chance of winning.

Tossing multiple coins at a time with limited funds

In this game, we still stick with tossing coins. However, multiple coins will be tossed at a time, and for each coin that has been tossed, you have to pay some money upfront. Although it’s almost the same game as before, how to play it is totally different now. With limited funds and a lot of opportunities, you cannot play every coin with a positive expected return available. Therefore, we have to consider all opportunities and allocate our capital to maximize returns.

Although our goal is to maximize returns, there is still a component that needs to be mentioned which is “Risk”. In an investing world, there are many different definitions of risk. In this article, we are not going to dig into each of them. However, one that is worth considering for all types of investors and traders is Risk of Ruin.

Risk of ruin is the risk that the investment will be lost to the point that there is no chance of recovering. In other words, it is game over in investing. For example, given two coins below

COIN 1

Coin with 50% chance to land heads and 50% chance to land tails

* Land Heads => Player receives 20% of the capital

* Land Tails => Player loses 10% of the capital

COIN 2

Coin with 50% chance to land heads and 50% chance to land tails

* Land Heads => Player receives 200% of the capital

* Land Tails => Player loses 100% of the capital

We can easily calculate expected returns for both coins. COIN 1’s expected return is 5% while COIN 2’s 50%. If we looked at the returns alone, COIN 2 seems like a no brainer. Some might pour all the capital available into COIN 2. However, if we consider that there is a 50% chance that we will ruin all the capital, we might not pour all of our money there. Imagine yourself building all your fortunes over thousands of coin tosses, and, with a flip of a coin, everything vanishes. The risk of such a game over is called risk of ruin.

To summarize, in this game, in addition to considering each investment (coin) individually like the last game, we have to compare them in both risk and reward aspects in order to allocate our capital efficiently. While we aim to maximize returns, we also have to minimize the chance of being ruined too.

Investing (Unknown chance, unknown outcome, unknown payout with limited funds)

We finally made it to investing. In investing and trading, all the components in the former two games still exist. However, in investing, no one tells us the chances of winning or losing and how much you gain or lose. Furthermore, unlike tossing coins whose number of outcomes is finite which is either heads or tails (discrete), in investing, the number of outcomes is unlimited (continuous). Therefore, our job as investors or traders is to estimate such outcomes, in order to make informed decisions based on those estimates. The methods we adopt might be different, but our goal is still the same.

In conclusion, our job as an investor / trader is to study each investment individually, try to estimate the outcomes and allocate our capital based on such estimations to achieve optimal risk-adjusted return. Many can go wrong in the process- we might miscalculate the risks or the returns or make the wrong decisions on allocation. Furthermore, even if we correctly calculate all that and make the right decisions, things can still go against us anyway by chance.

Therefore, what we can do is to learn from it and improve our process to minimize such a chance.

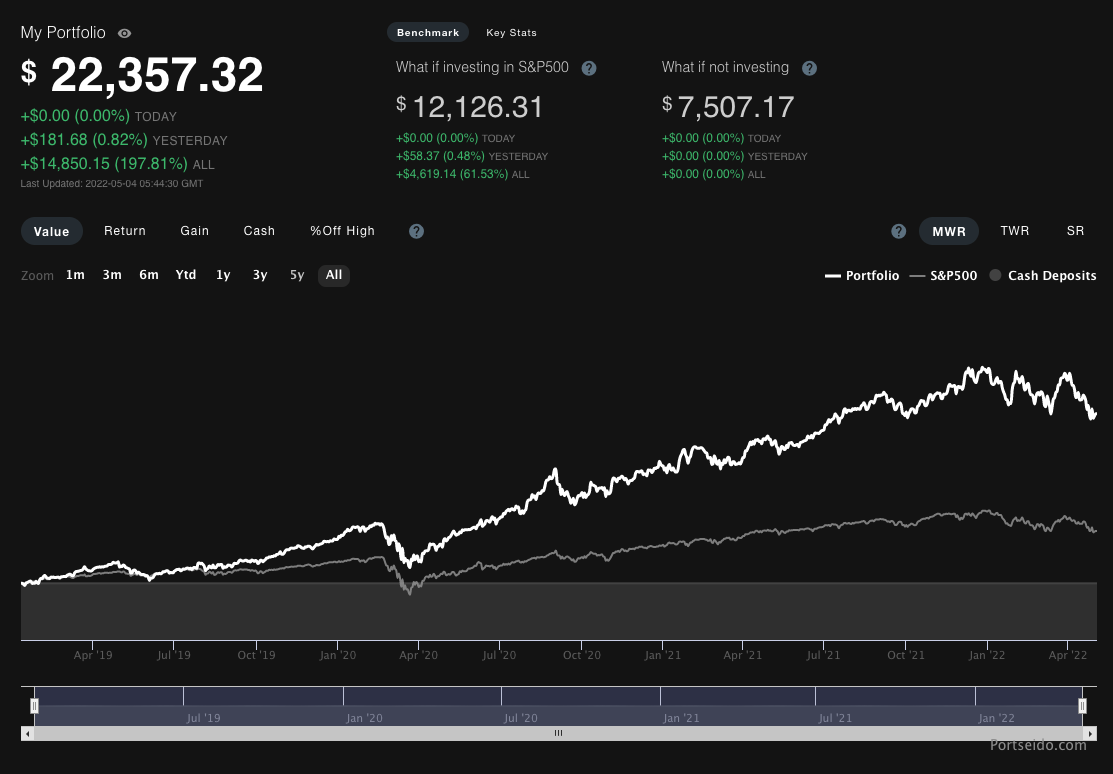

If investing is a game, consider Portseido a scoreboard.

At Portseido, we aim to help investors track their investments with less effort and improve their process by learning from their own past decisions. Furthermore, we offer a bunch of analytics on top of that with risk measurements, benchmarking, trade analysis and more.