What is Money-Weighted Return (MWR)?

Article last updated: October 23, 2023

Measuring the performance of investments is a fundamental task for all investors and portfolio managers. One of the key metrics used for this purpose is the Money-Weighted Return (MWR). This article will delve into what MWR is, how it's calculated, its relationship with Internal Rate of Return (IRR), and how it differs from other methods.

What is Money-Weighted Return (MWR)?

Money-Weighted Return or Dollar-Weighted Return, often referred to as MWR, is a performance measurement that considers all cash flows entering and exiting a portfolio. Unlike other methods of calculating returns, such as simple return or time-weighted return, MWR provides a comprehensive assessment of portfolio performance by taking into account both the size and timing of all cash flows within the portfolio, hence reflecting the true performance of your portfolio.

How do you calculate Money-Weighted Returns?

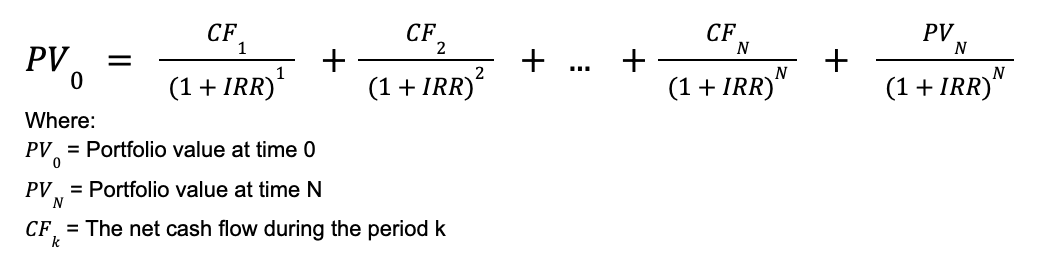

Mathematically, Money-Weighted Return is calculated by solving for a rate of return that equates the current portfolio value to the net present value or discounted value of all future cash flows. The equation reads

Here, the cash flows include not only contributions and withdrawals but also dividends and the terminal portfolio value. Note that CF_k reflects the cashflow received, so if we deposit more cash, then it will be a negative number, while if you withdraw or receive a dividend, then it will be a positive number. We can see that MWR incorporates the size and timing of all relevant cash flows, resulting in a performance measure that truly reflects the portfolio's performance.

The formula describing the cash flows in the portfolio above involves solving for the Internal Rate of Return (IRR) variable shown there. The solution of such an equation is precisely the Money-Weighted Return.

Alternatively, you can try calculating money-weighted return using our free money-weighted return calculator.

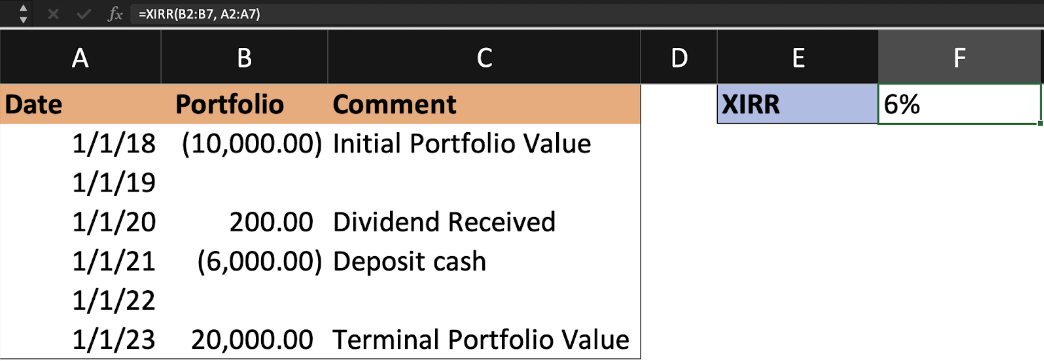

How do you calculate Money-Weighted Returns in Excel or Google Sheets?

Solving for the IRR that makes the equation above equal is difficult to do by hand or even with a simple calculator. Fortunately, you can do this quite easily in Excel or Google Sheets. In either Excel or Google Sheets, you can use the XIRR function to solve the equation above and calculate the Money-Weighted Return. Simply input the initial portfolio value and all related cash flows with date and size as shown below, and the function will determine the rate of return that equates to the equation mentioned earlier. The output is precisely the money-weighted return you want.

A couple of things to note when inputting the data for such calculation

- We put in negative value for the initial portfolio and all further contributions/deposits. Essentially, anything that considered our invested capital.

- We put in positive value for all dividends, cash withdrawal, sale proceeds, and the final portfolio value.

Is a Money-Weighted Return the same as an IRR?

Yes, Money-Weighted Return is the same as the Internal Rate of Return (IRR). It's also referred to as Dollar-Weighted Return because it places more weight on the performance during periods when the dollar amount is high, reflecting the influence of cash flows on returns.

What is the difference between Time-Weighted and Money-Weighted Returns?

There are significant differences between Time-Weighted and Money-Weighted Returns:

Time-Weighted Return: This method focuses on computing the return at each time frame and then takes the average of these returns. It is particularly useful when you have limited control over your cash flows and want to evaluate your performance over specific time intervals.

Money-Weighted Return: In contrast, Money-Weighted Return considers the timing and size of all cash flows. It provides a more accurate reflection of portfolio performance but may not necessarily represent the skill of a portfolio manager if they lack control over cash flows coming in and out.

Is Money-Weighted Return Better?

The short answer is it depends. The suitability of Money-Weighted Return versus Time-Weighted Return depends on what you aim to capture:

Money-Weighted Return is excellent for reflecting the genuine portfolio performance, especially when you want to account for the impact of cash flows. However, it may not accurately gauge the skill of a portfolio manager if they have limited control over cash flows.

Time-Weighted Return is better at measuring performance over specific time intervals, making it useful for assessing the skills and performance of a manager, especially when cash flow control is limited.

In conclusion, Money-Weighted Return is a valuable tool for assessing investment performance, particularly when it's essential to account for the influence of cash flows. However, the choice between Money-Weighted and Time-Weighted Returns depends on the specific context and what you want to evaluate in your investment strategy.

Measure your portfolio performance with Portseido

We know measuring portfolio performance correctly can be lots of work, so we make it easy for you. Portseido helps you measure your portfolio performance easily and effortlessly. We provide all type of return calculation from simple return, time-weighted return, and money-weighted return. We offer a range of user-friendly performance report features, including monthly report, dividend report, all with easy-to-understand visualizations to help you assess your true financial performance.

But that's not all – Portseido isn't limited to just performance measurment. We provide a comprehensive portfolio tracker that covers global stocks, ETFs, mutual funds, and cryptocurrencies. Supporting multiple currencies and the management of multiple portfolios, our platform generates powerful performance reports, in-depth analytics, and beautiful portfolio visualization, giving you a complete overview of your investments. With Portseido, tracking your portfolio performance and managing your portfolio has never been simpler.