Portfolio Turnover - What is it? How to calculate?

Article last updated: April 4, 2024

In the world of investing, understanding portfolio turnover is crucial for investors aiming to optimize their returns while minimizing costs. In this article, we'll dive into what portfolio turnover is, how to calculate it and what is a good turnover ratio

What is Portfolio Turnover?

Portfolio turnover is a metric to measure how frequently the investments within a portfolio are bought and sold over a specific period. It is usually measured on a 12-month basis. A high turnover rate indicates frequent trading activity, while a low turnover rate implies a more passive investment approach. So a long-term investor will usually have a lower turnover than a day trader does.

How to calculate portfolio turnover?

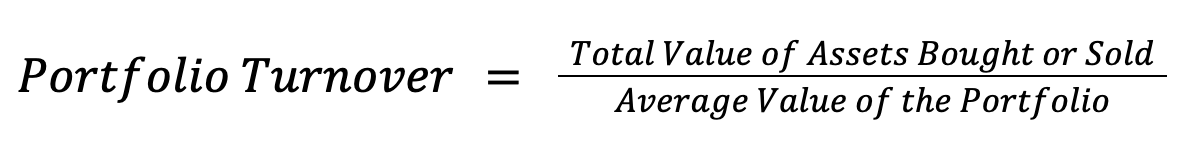

The portfolio turnover ratio is calculated by dividing the total value of assets bought or sold within a specific period by the average value of assets held in the portfolio during the same period.

Portfolio Turnover Formula:

Where:

- Total Value of Assets Bought or Sold = Total value of assets bought or sold within a specific period (whichever is less)

What does portfolio turnover mean to investors?

Portfolio turnover indicates how frequent the portfolio activities are. The higher portfolio turnover means there are more trading activities. When there's a lot of buying and selling, it usually means paying more fees, taxes and other costs. These costs can eat into your profits, leaving you with less money in the end. On the transaction cost side, it is obvious since every transaction has a cost related to it (i.e. transaction fees / commissions, price spread & more).

On the capital gain taxes, by realizing the gain every period instead of deferring it to the future period, it will cost every gain more. Charlie Munger illustrates it as followed:

“If you're going to buy something which compounds for 30 years at 15% per annum and you pay one 35% tax at the very end, the way that works out is that after taxes, you keep 13.3% per annum. In contrast, if you bought the same investment, but had to pay taxes every year of 35% out of the 15% that you earned, then your return would be 15% minus 35% of 15%-or only 9.75% per year compounded. So the difference there is over 3.5%. And what 3.5% does to the numbers over long holding periods like 30 years is truly eye-opening.”

How much of a difference? You asked. Assuming we invest $10,000 at the beginning, we will end up with $162,981 if we pay the 35% tax rate every year. On the other hand, you will end up with $430,377 if you pay it once at the end of 30 years. That’s right. It’s 2.64 times more.

What's a Good Portfolio Turnover Ratio?

A good portfolio turnover ratio depends on various factors, including investment strategy, market conditions, and investor objectives. Generally, given the same strategy and return profile, a portfolio with lower turnover rate is preferred since the transaction costs are lower. For the long-term investor, the portfolio turnover can be lower than 10% or even 0% (no action at all). For example, Terry Smith’s Fundsmith, one of the greatest long-term investors, has a record of very low turnover with most of the time the turnover rates are between 2-5% and 11.1% in 2023.

Charlie Munger famously stated, "Investing is where you find a few great companies and then sit on your ass," highlighting the value of patience and conviction in long-term investing. Terry Smith also states a similar investing philosophy, “Buy good companies. Don’t overpay. Do nothing.” He’s so committed to the “Do nothing” part that he also tracks and discloses the portfolio turnover every year.

Understanding portfolio turnover is one of the important aspects which are often overlooked by investors. By calculating and monitoring turnover ratios, investors can make informed decisions, minimize costs, and align their investment approach with their long-term goals. With tools like Portseido, tracking portfolio turnover has never been easier, empowering investors to navigate the complexities of the market with confidence.

Great further reads:

- Investing for growth by Terry Smith

- Poor Charlie's Almanack by Charles T. Munger