Return on Capital Employed (ROCE) - Definition, Formula & Example

Article last updated: October 29, 2023

What is Return on Capital Employed (ROCE)?

Return on Capital Employed, or ROCE, is a popular financial metric that measures a company's efficiency in utilizing its capital to generate profit. The higher the ROCE, the better a company is at efficiently using its capital resources.

How to Calculate ROCE?

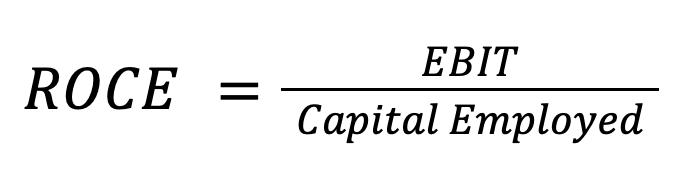

Formula

Where: EBIT is earnings before interests and taxes for the period and Total Capital Employed is a sum of Shareholder’s Equity and Non-Current Liabilities at the beginning of the period.

ROCE Example

Let's consider a real company in this case. From AAPL 10k document, for the financial year 2022, AAPL earned EBIT of $119,437 million while, at the beginning of 2022 financial year, its shareholder’s equity and non-current liabilities were at $63,090 million and $162,431 million respectively. Since we try to consider how efficient the company is in utilizing its capital, the capital employed at the beginning of the period should be used.

ROCE = 119437 / (63090 + 162431) = 52.96%

Why is ROCE Important?

ROCE holds significant importance for various reasons. First, it serves as a representative indicator of a company's capital efficiency and profitability. Second, ROCE is a valuable tool for comparing the efficiency of different companies within the same industry or across industries.

It is often analyzed in conjunction with a company's growth opportunities. Companies with high ROCE and substantial growth opportunities can reinvest their profits in these opportunities. This reinvestment can result in higher profits and more capital being reinvested, creating a cycle of growth and prosperity.

ROCE vs. ROIC (Return on Invested Capital):

ROCE and ROIC both measure capital efficiency, but ROIC typically considers only the capital directly invested in a company, excluding excess cash. While ROCE uses Capital Employed which is Shareholder’s Equity plus Non-Current Liabilities, ROIC uses Invested Capital which also includes Shareholder’s Equity but the Liabilities portion is a bit different. Instead of Non-Current Liabilities, it uses all the interest-bearing debt which can be in both Current Liabilities and Non-Current Liabilities. For example, in the AAPL case, invested capital may include only Term Debt from Non-Current Liabilities and Commercial Paper and Term Debt from Current Liabilities.

ROCE vs. ROA (Return on Assets):

ROA measures a company's ability to generate profit from its total assets, not just the capital employed. This means the only part that it differs is that ROCE excludes Current Liabilities from the calculation.

ROCE vs. ROE (Return on Equity):

ROE measures profitability relative to shareholders' equity. Since it only includes the equity portion in the balance sheet, the higher ROE might be resulted from a higher leverage the company uses. ROCE offers a broader view by incorporating both equity and non-current liabilities, making it more comprehensive.