What is Time-Weighted Return (TWR)?

Article last updated: November 2, 2023

There are multiple methods to calculate return to evaluate the performance of your investment portfolio, from time-weighted return and money-weighted return to simple return. As a result, it’s essential to use return metrics that provide an accurate picture of your performance and capture what you aim to gauge. Time-weighted return is one such metric that allows investors to see their success while eliminating the impact of external factors like cash flows. In this article, we'll explore what time-weighted return is, how it's calculated, and how it differs from other methods of measuring performance.

What is Time-Weighted Return (TWR)?

Time-weighted return (TWR) is a measure of investment performance that calculates the return for each time period separately and then combines these returns with equal weight, hence the name "time-weighted" as it weights each time period equally regardless of the portfolio size at each time. Unlike other methods, such as simple return or money-weighted return, TWR removes the influence of cash flows and assesses the performance at each time period without any bias introduced by the timing or size of cash inflows or outflows.

How Do You Calculate Time-Weighted Returns?

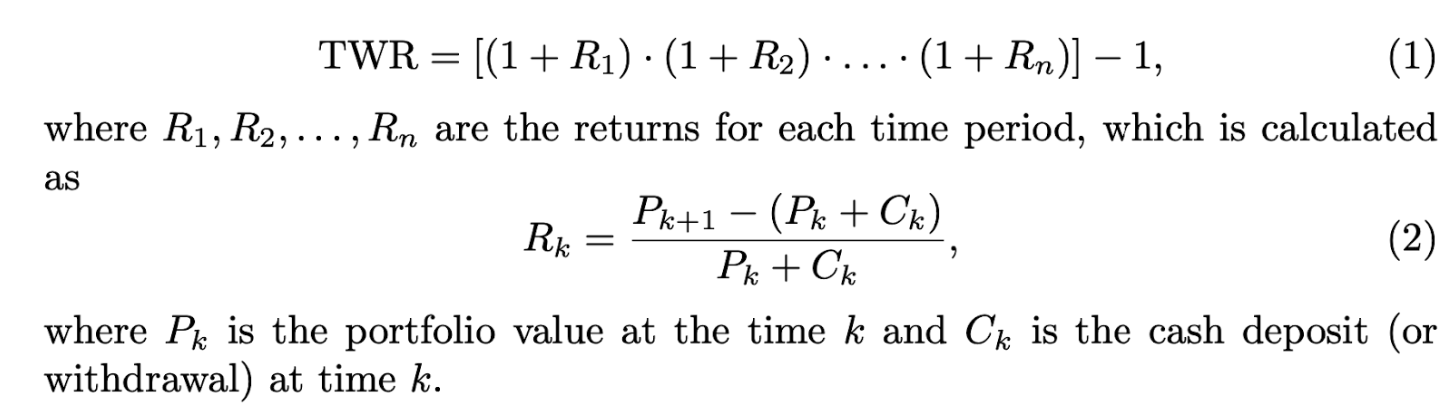

To calculate time-weighted returns, you need to follow these steps:

- Determine the initial portfolio value at the beginning of the investment period and cash deposited.

- Calculate the return for each time period separately. This can be done by taking the ratio of the ending portfolio value to the beginning portfolio value plus cash change.

- Combine these returns by adding 1 to each of them and multiplying them. Then minus 1 to the end result.

Time-Weighted Return Formula

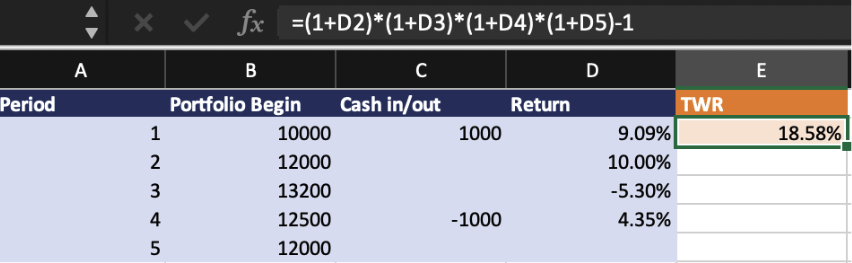

How Do You Calculate Time-Weighted Returns in Excel?

From the formula above, we can see that calculating time-weighted returns in Excel is relatively straightforward. You can use the following steps:

- Input the portfolio value at the start of each period and record any cash flows (inflows or outflows) during that period.

- Calculate the return for each period using the formula mentioned earlier.

- Take the one plus return and multiply all the return from all periods to obtain the TWR.

Alternatively, you can try calculating time-weighted return using our free time-weighted return calculator.

Is a Time-Weighted Return the Same as a CAGR?

While time-weighted return and the Compound Annual Growth Rate (CAGR) are similar in that they both consider investment returns over time, they are not the same. CAGR is a specific term referring to a time-weighted return that assumes a constant growth rate over the entire investment period, while TWR calculates the returns separately for each time period and then combines them.

What Is the Difference Between Time-Weighted and Money-Weighted Returns or IRR?

There are significant differences between time-weighted return and money-weighted return (Internal Rate of Return, IRR). Money-weighted return considers the timing and size of all cash flows in and out of the portfolio. It can be heavily influenced by the timing of contributions or withdrawals. On the other hands, time-weighted return focuses on computing the return at each time period and then takes the geometric average of these returns. It eliminates the influence of external cash flows, making it a more suitable measure when you have limited control over cash flow timing.

What Is the Difference Between ROI and Time-Weighted Return?

Return on Investment (ROI) is another metric used to assess investment performance and it is often confused with time-weighted return. They are both similar in the sense that both do not account for the timing or size of cash flows. However, the calculation of both are slightly different. ROI is a relatively simpler measurement that only calculates the percentage gain or loss relative to the initial investment, whereas time-weighted return is a bit more detailed as it measures each time period separately before equally weighing those performances over time.

Is Time-Weighted Return Better?

The suitability of time-weighted returns depends on your specific objectives and circumstances.

Time-weighted return excels at measuring performance at each time period equally, making it a valuable tool for evaluating the skills and performance of an investment manager without being influenced by external factors.

On the other hand, money-weighted return or IRR is better at reflecting the true portfolio performance, but it may not accurately reflect the manager's skills if they have limited control over cash flows.

In conclusion, the choice between time-weighted return and other performance metrics depends on your investment goals and the level of control you have over cash flows. Understanding the nuances of each method can help you make more informed investment decisions and accurately assess your portfolio's performance.

Measure your portfolio performance with Portseido

We know measuring portfolio performance correctly can be lots of work, so we make it easy for you. Portseido helps you measure your portfolio performance easily and effortlessly. We provide all type of return calculation from simple return, time-weighted return, and money-weighted return. We offer a range of user-friendly performance report features, including monthly report, dividend report, all with easy-to-understand visualizations to help you assess your true financial performance.

But that's not all – Portseido isn't limited to just performance measurment. We provide a comprehensive portfolio tracker that covers global stocks, ETFs, mutual funds, and cryptocurrencies. Supporting multiple currencies and the management of multiple portfolios, our platform generates powerful performance reports, in-depth analytics, and beautiful portfolio visualization, giving you a complete overview of your investments. With Portseido, tracking your portfolio performance and managing your portfolio has never been simpler.