Dividend Aristocrats - A Guide to Consistent Income

Article last updated: January 4, 2024

Dividend Aristocrats, a term coined for a select group of companies, holds a distinguished position in the investment world. In this article, we'll delve into the concept of Dividend Aristocrats, explore their historical performance, discuss investment opportunities, and highlight some potential new members in 2023.

What are Dividend Aristocrats?

Dividend Aristocrats represent a unique set of companies that have demonstrated not only financial stability but also a long-term commitment to returning value to their shareholders. To be part of this elite group, a company must have a track record of raising dividends annually for at least 25 years. This criterion aims to identify businesses that have withstood the test of time and continue to perform consistently well.

How can I invest in Dividend Aristocrats?

Investing in Dividend Aristocrats can be done through various avenues, with one popular option being Exchange-Traded Funds (ETFs). The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is specifically designed to track the performance of companies in the S&P 500 that have a history of consistently increasing dividends. By investing in NOBL, investors gain exposure to a diversified portfolio of Dividend Aristocrats, reducing individual company risk.

Additionally, investors can choose to build their portfolios by directly selecting individual Dividend Aristocrat stocks. Conducting thorough research on the financial health, industry trends, and growth prospects of each company can help in making informed investment decisions.

Is Dividend Aristocrats a good investment?

Investors often consider Dividend Aristocrats as a reliable source of income. These companies have demonstrated resilience and financial strength by consistently increasing their dividends, even during economic downturns. By focusing on long-term stability and sustainable growth, Dividend Aristocrats can offer investors a unique combination of income and potential for capital appreciation.

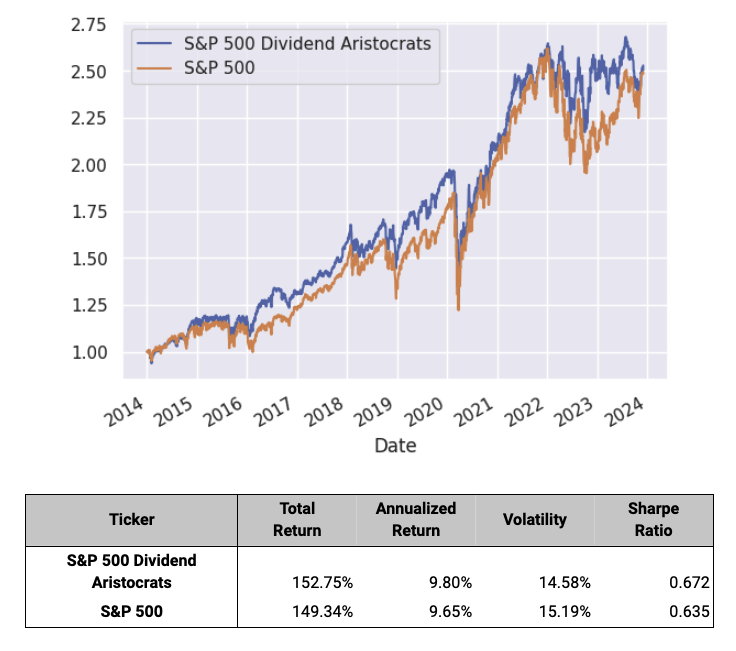

To gauge the attractiveness of Dividend Aristocrats as an investment, one can examine historical performance.

Source: Data from Yahoo Finance

As depicted in the graph and table above, the annual return of the Dividend Aristocrats index since inception is 9.8%, compared to the 9.65% of the S&P500. Simultaneously, it exhibits lower volatility at 14.58% in contrast to the S&P500's 15.19%, making it a better-performing investment with a higher Sharpe Ratio, although the difference is not significant.

Which stocks are the new Dividend Aristocrats in 2023?

The list of Dividend Aristocrats is subject to frequent updates, involving both additions and removals. In the current year, the February 2023 adjustments welcomed Nordson Corp. (NDSN), CH Robinson Worldwide Inc. (CHRW), and JM Smucker Co. (SJM). Moreover, the list expanded further in August 2023 with the addition of Kenvue.

Conversely, this year witnessed the removal of VF Corp (VFC) and AT&T (T) from the esteemed list. Both companies experienced a reduction in dividends, leading to their exclusion from the Dividend Aristocrats category.

In conclusion, Dividend Aristocrats represent a compelling investment option for those seeking a combination of income and stability. Through careful consideration of historical performance and utilizing investment vehicles like ETFs, investors can access a diversified portfolio of companies with a proven track record of consistent dividend growth. As we look ahead to 2023, keeping an eye on emerging candidates for the Dividend Aristocrats list can provide valuable insights for investors seeking to build a resilient and income-generating portfolio.