Portfolio Weight - What is it? How to calculate?

Article last updated: November 1, 2023

What is Portfolio Weight?

Portfolio weight is the percentage of a specific position or asset type in an investment portfolio. It indicates the extent of exposure the portfolio has to that particular asset. Understanding portfolio weight is vital because it allows investors to assess the concentration and diversification of their investment holdings.

How to Calculate Portfolio Weight?

Portfolio weight can be calculated by dividing the value of a specific position by the total value of the entire investment portfolio. Typically, values are measured in monetary terms, but in some cases, it can also be measured in the number of shares held.

Portfolio Weight Formula:

Portfolio weight is the percentage of asset value to the total portfolio value. It can be calculated by dividing asset position value by total portfolio value. Alternatively, you can also use our free Portfolio Weight Calculator to calculate it for you.

Why is Portfolio Weight Important?

Understanding and monitoring portfolio weight is crucial for several reasons:

Risk Management: By knowing the portfolio weight of each asset, investors can assess the risk associated with their holdings. Overconcentration in a single asset or asset class can lead to heightened risk if that asset experiences a downturn.

Diversification: Portfolio weight analysis facilitates diversification. Investors can adjust their portfolio weightings to achieve the desired level of diversification.

Performance Attribution: It helps in evaluating the performance of individual assets within the portfolio. By tracking changes in portfolio weight over time, investors can identify which assets have contributed the most to portfolio gains or losses.

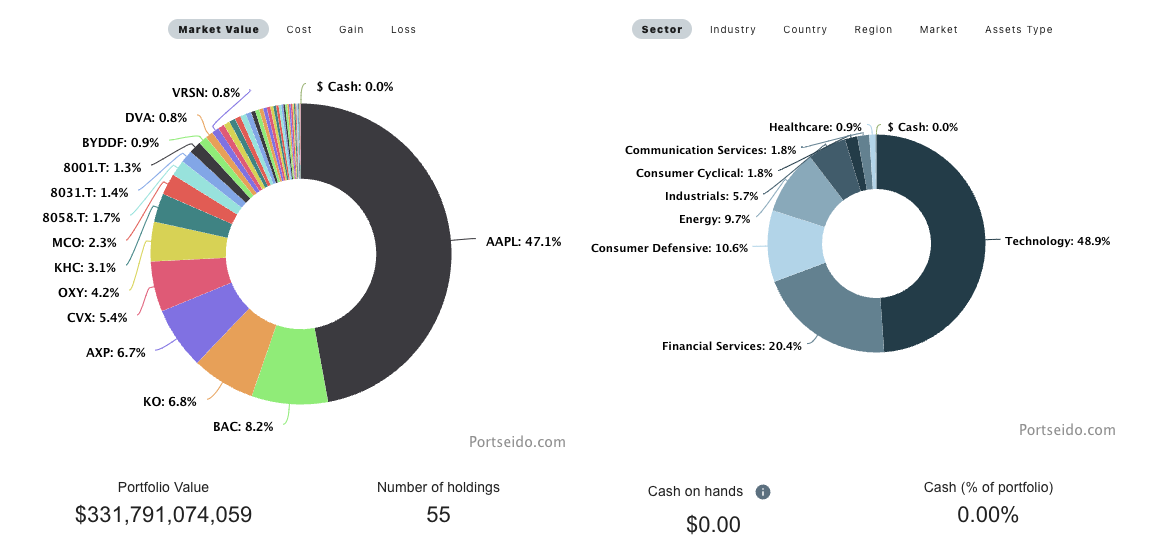

Examples of Portfolio Weights

The above image is Warren Buffett’s Berkshire Hathaway public company portfolio as of November 1st, 2023 (excluding cash). With $156 billion of AAPL position and $331 billion of portfolio value, we can calculate the portfolio weight on the AAPL position as follows.

Portfolio Weight = $156 billion / $331 billion = 47.1%

This means almost half of the portfolio is invested in AAPL.

On the other hand, we can also aggregate the value into the company's sector too. For example, calculating portfolio of the financial services sector of Berkshire Hathaway portfolio. This can give us more light on the exposure of the kind of sector dependent on the portfolio.