Yield on Cost - Definition and Formula

Article last updated: October 15, 2023

For dividend investors, many metrics are quite useful for evaluating the performance of their investments and helping them make informed decisions about their portfolios. One of the metrics that many dividend investors use is the "yield on cost." In this article, we will delve into this metric, understanding what it is, how to calculate it, and its applications.

What is the Yield on Cost?

Yield on Cost is a financial metric measuring dividend paid as a percentage of initial cost of the stock purchased. As the name suggests, the yield on cost aims to capture the yield from stocks in relation to their cost basis. This metric allows investors to see the dividend return on their initial investment in a stock. Put simply, the yield on cost measures a stock's annual dividend divided by the average cost basis. It provides a way to assess how the income generated by an investment has grown over time, making it particularly valuable for long-term investors.

How to Calculate the Yield on Cost?

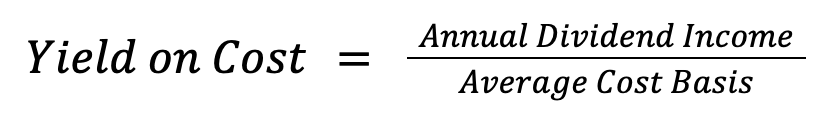

Calculating the yield on cost is a straightforward process. To determine it, you need to know the annual dividend income you receive from a particular stock and your average cost basis for that stock. The formula for calculating the yield on cost is:

What is the Difference Between the Dividend Yield and Yield on Cost?

It's important to distinguish between the dividend yield and yield on cost, as they serve different purposes. The dividend yield measures the annual dividend paid by a security divided by its current market price. On the other hand, the yield on cost looks at the annual dividend income in relation to the average cost basis. While both metrics are related to dividends, they capture different aspects of an investment. The dividend yield reflects the current return on your investment, while the yield on cost reflects how that return has changed over time.

What is the Yield on Cost Used For?

The yield on cost is primarily used by long-term investors to assess the performance of their investments over time. It helps them understand how the income generated from their initial investment has grown, providing a valuable perspective on the effectiveness of their investment decisions. Investors can use this metric to evaluate the success of their long-term strategies and to make informed decisions about whether to hold, sell, or add to their positions.

What is a Good Yield on Cost?

Since the yield on cost is calculated by dividing annual dividend income by the average cost, it doesn't take into account the time an investor has held the stock. Therefore, it can vary significantly and may not have a universally defined 'good' yield on cost. However, it is typically expected that the yield on cost will increase over time to reflect the company's growth and its ability to raise dividends over time

Bottom Line

In conclusion, the yield on cost can be a valuable metric for dividend investors to evaluate the performance of their investments, especially when taking a long-term view. It provides insights into how the income generated from an initial investment has evolved over time. However, it's essential to remember that this metric has limited usefulness when it comes to making forward-looking investment decisions where current and annualized performance metrics such as dividend yield might be more useful.

Track Your Dividends Automatically with Portseido

We know tracking dividends can be painful and high-effort, so we make it easy for you. Portseido helps you track your dividends easily and effortlessly. We automatically keep track of your dividends and integrate them into your performance calculations. We offer a range of user-friendly dividend tracking features, including projected income, a dividend calendar, dividend yield, and yield on cost calculation, all with easy-to-understand visualizations to help you assess your true financial performance.

But that's not all – Portseido isn't limited to just dividends. We provide a comprehensive portfolio tracker that covers global stocks, ETFs, mutual funds, and cryptocurrencies. Supporting multiple currencies and the management of multiple portfolios, our platform generates powerful performance reports, in-depth analytics, and beautiful portfolio visualization, giving you a complete overview of your investments. With Portseido, tracking dividends and managing your portfolio has never been simpler.