What is Asset Allocation? Why is it important to portfolio?

Article last updated: September 29, 2023

What is Asset Allocation?

Asset Allocation refers to the distribution of funds across diverse investment assets to fit your financial goal and within your risk tolerance. While there are many asset allocation strategies, the key is to allocate the portfolio that suits your individual needs and helps you achieve your long-term objectives while keeping the risk under the acceptable level. Whether you're aiming for stability or growth, asset allocation can be your compass in the world of investing.

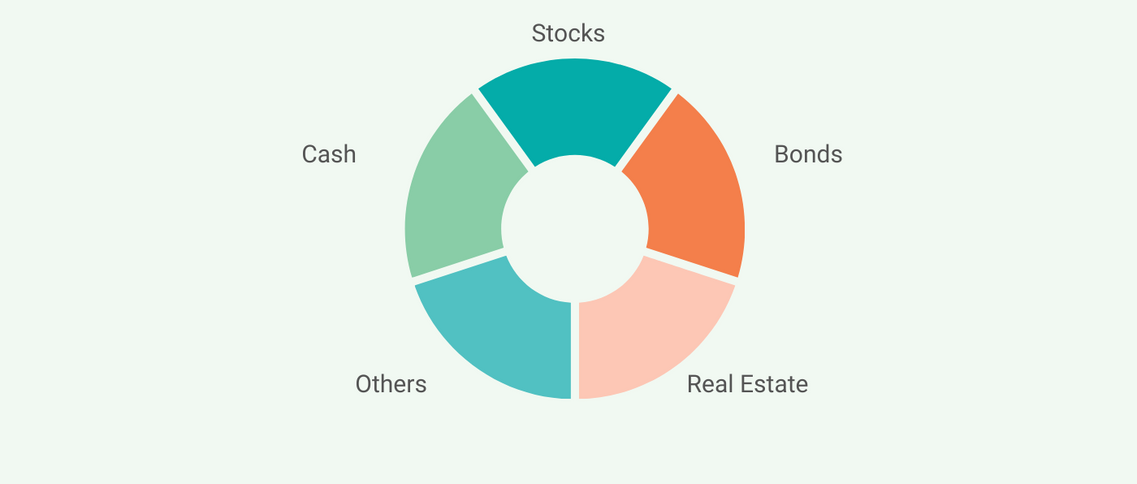

Asset Classes

Asset allocation involves dividing your investments among different asset classes, each with its own risk and return characteristics. Here are the primary asset classes:

1. Stocks

Stocks (Equity) are ownership in a company. They are often classified into subclasses by their market capitalization, market listed, industries and sectors for example large-cap stocks, mid-cap stocks, small-cap, emerging market stocks, and more.

2. Bonds

Bonds are debt securities issued by governments or corporations. They are often further categorized by entity issued, maturity periods and credit ratings for example corporate bonds, government bonds, municipal bonds, and more.

3. Real Estate

Real estate investments involve purchasing physical properties or Real Estate Investment Trusts (REITs), which offer exposure to the real estate market.

4. Cash

Cash and cash equivalents, like money market funds or short-term certificates of deposit (CDs), provide liquidity and safety.

5. Alternative Investments

Alternative investments include hedge funds, private equity, and commodities. They offer diversification beyond traditional asset classes but can be higher risk.

Why is Asset Allocation important to investors?

Fits Individual Needs

Individual investors have different financial goals and varying levels of risk tolerance. There's no one-size-fits-all portfolio. Asset allocation allows you to customize your investment strategy to meet your specific needs.

Balancing Risk and Reward

Asset allocation is the key to finding the right balance between risk and reward. For instance, retirees may prioritize capital preservation over high returns due to limited earning years. In contrast, young investors might focus on growth while having a higher risk tolerance.

Managing Economic Surprises

Asset allocation takes into account the varying reactions of asset classes to economic conditions. By balancing assets based on their structural characteristics, the impact of economic surprises can be minimized. This means your portfolio can weather changes in the economic environment more effectively.

Examples of Asset Allocations

Ray Dalio's All Weather Portfolio

"Launched in 1996, All Weather was originally created for Ray’s trust assets. It is predicated on the notion that asset classes react in understandable ways based on the relationship of their cash flows to the economic environment. By balancing assets based on these structural characteristics the impact of economic surprises can be minimized. Market participants might be surprised by inflation shifts or a growth bust and All Weather would chug along, providing attractive, relatively stable returns." - Bridgewater Research & Insights

Warren Buffett's 90/10 Investing Strategy

"My money, I should add, is where my mouth is: What I advise here is essentially identical to certain instructions I’ve laid out in my will. One bequest provides that cash will be delivered to a trustee for my wife’s benefit. (I have to use cash for individual bequests, because all of my Berkshire shares will be fully distributed to certain philanthropic organizations over the ten years following the closing of my estate.) My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers." - Berkshire Hathaway 2013 Annual Report