Investment Portfolio Performance Tracker

Monitor and Measure Portfolio Return Correctly

Track Worldwide Stocks, ETFs, Mutual Funds & More

Trusted by investors in over 160+ countries

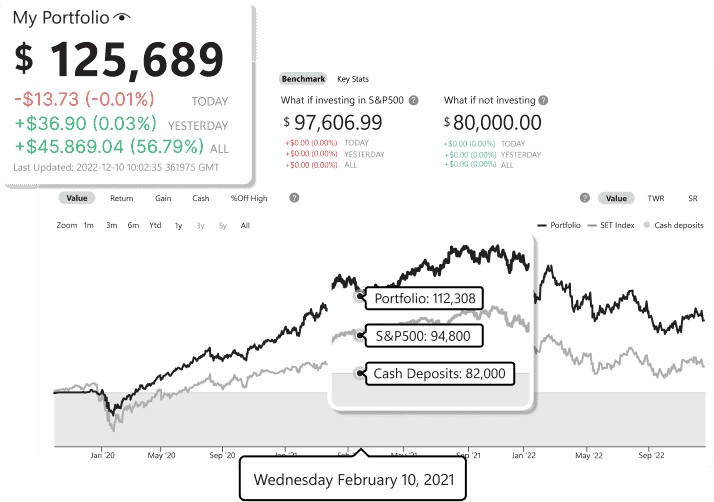

Track Portfolio Performance Correctly

See all of your investments in one place at Portseido with 70+ stock markets all over the world, cryptos and etfs and track your portfolio performance correctly alongside your own benchmarks inclusive of historical gains, fees, dividends and exchange rate.

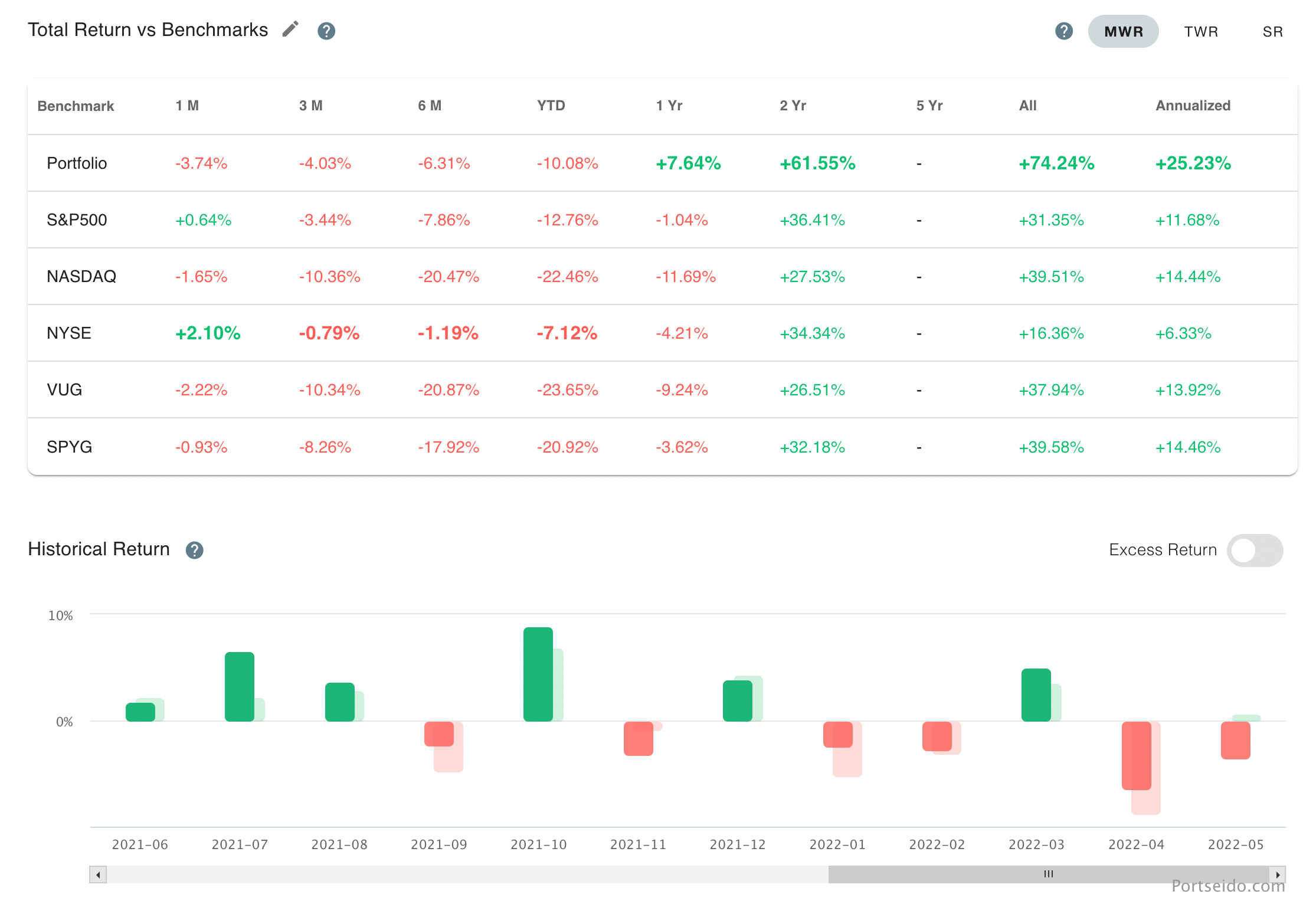

Monitor portfolio performance against benchmarks

Tracking your performance can be a time-consuming task. Portseido helps you automate such things, so you can spend your time where it matters most. Plus, the historical risk measurement and performance benchmarking to see how you are doing side by side with your preferred benchmarks in your own currency.

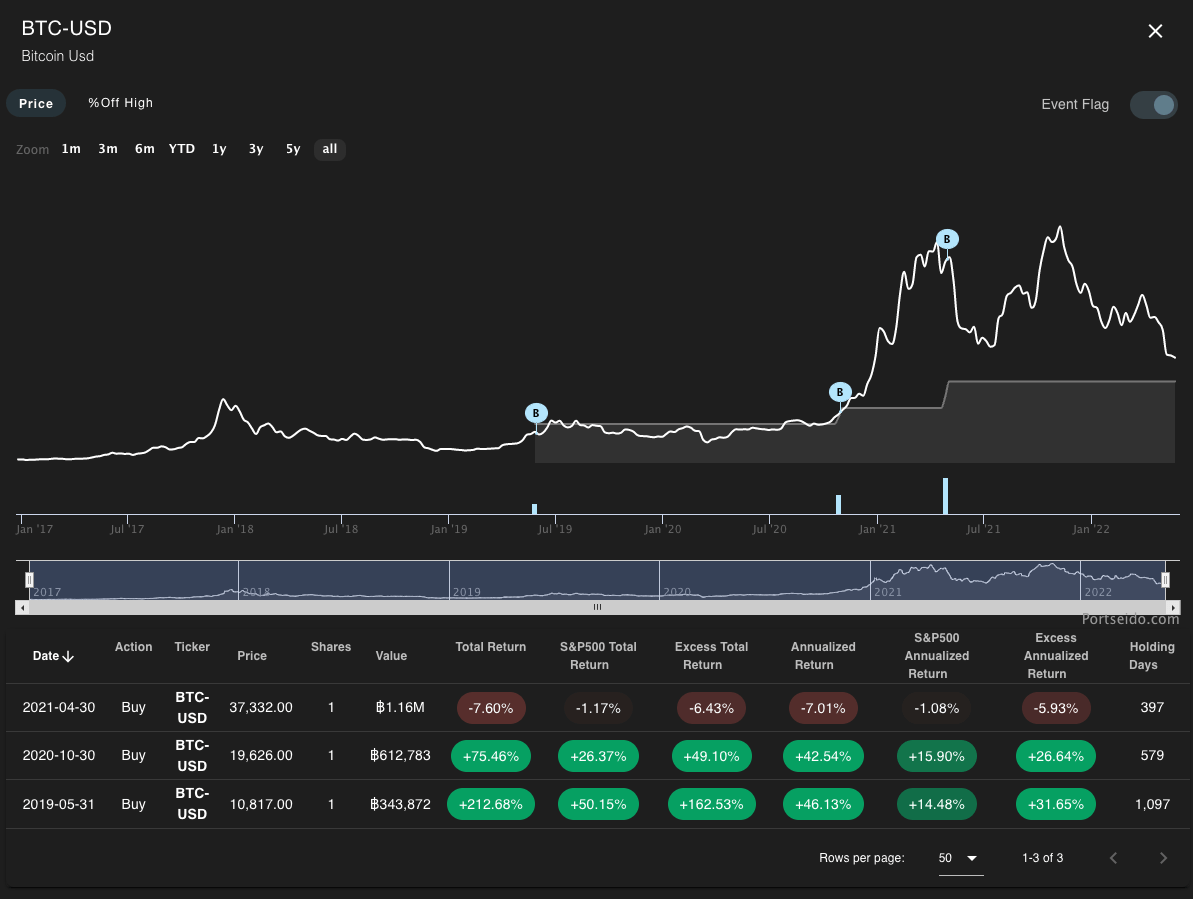

Identify your performance drivers

Instead of just displaying performance, Portseido digs deeper into each transaction to identify what were investors doing right and wrong.

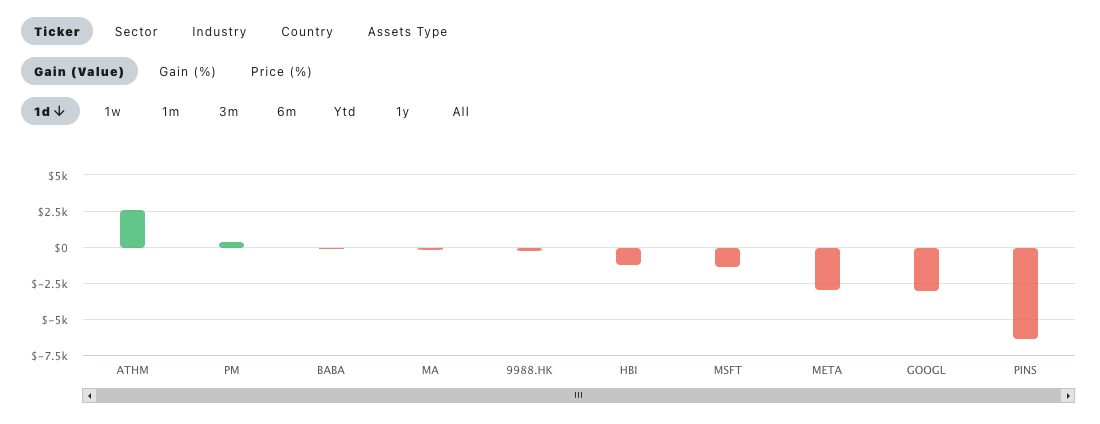

Breakdown your gains by positions

Analyze portfolio performance by looking deeper into portfolio's current positions, aggregating historical gains and losses by ticker, sector, industry, country and asset classes.

Meet investors who choose Portseido

Investors all over the world track their investments with Portseido.

Which assets do Portseido support?

Portseido tracks a wide variety of assets including US, UK, Europe, Canada, Singapore, Australia, Brazil, South Korea and other global stocks from more than 70+ exchanges, 20000+ ETFs, and Cryptocurrencies. You can search for your asset here.

Is Portseido available for free?

You can create a free portfolio on Portseido. This will have access to almost all of the functionalities. However, when your number of trades get larger, you will have to upgrade to see the full portfolio. See more on pricing page.

How can I track all my investments?

Simply input the trades you made via our intuitive interface or by uploading a file containing your trade history. Once Portseido has data on your past trades, it’s ready to track and visualize all your portfolios in various aspects, historical performance, trade analytics, allocations and many more. Our goal is to empower you to answer all the questions you have about your own portfolio. Check out our help center on the specifics of how to get set up.

Can I import my trade history from my Brokerage?

Absolutely! Portseido supports file formats from major brokerages - DEGIRO, Trading 212, TD Ameritrade, Charles Schwab, M1 Finance, Fidelity, Freetrade, Interactive Brokers, Hellostake, Questrade, Vanguard, Nabtrade, Zerodha, Selfwealth, Revolut, RBC Direct, XTB, City National Bank, eToro, Webull, E*TRADE, SAXO, JP Morgan Chase, Firstrade, FlowBank, Superhero, Robinhood, Raiz, SoFi, CMC Markets, DriveWealth, Lightyear, TIAA, LHV, Sharesies, LYNX, TradeStation, Merrill Edge, National Bank Direct Brokerage, Justwealth, Invest Engine, CommSec, Avanza, Nordnet, Moomoo, Tiger Brokers, InnovestX, Bell Direct, Freedom24, Portu, Groww, Desjardins, Bux, Wealthsimple, Trade Republic, Citi Self Invest, Swissquote, Directa, BMO, Qtrade, Scalable Capital, Hatch Invest, Pearler, Interactive Investor, TradeVille, Patria Finance, Ally Invest, tastytrade, finanzen.net ZERO, FFB, Westpac, True Wealth, betashares, Morgan Stanley. Don’t see your brokerage on the list? You can send us a request to support your platform! In addition, you can also upload your data from other applications too such as Yahoo Finance, Google Finance and Portfolio Performance app

How to calculate investment performance?

As an investment portfolio management software, Portseido offers a full picture of portfolio performance to all investors. In addition to the price fluctuations, Portseido automatically includes foreign exchange rate gains, dividend incomes, brokerage fees and withholding taxes into the calculation. Furthermore, Portseido offers a wide range of performance metrics including simple return, time-weighted return, money-weighted return, beta, drawdown and much more

How to benchmark investment portfolio performance?

As an investor, opportunity cost is the true cost of investing. It is the foregone benefit from choosing to invest in one alternative over another. To track this cost over time, investors have to bemchmark their performance. Portseido can help simplifying the process by automatically benchmarking the investment portfolio performance to major indices and ETFs around the globe.