How to Calculate Portfolio Return?

Article last updated: February 2, 2024

Understanding portfolio return is important for all investors to gauge the performance of their investments accurately. Whether you're a seasoned investor or just starting, knowing how to calculate portfolio return empowers you to make informed decisions and assess your investment strategies effectively. In this guide, we'll delve into different methods of calculating portfolio return and provide step-by-step instructions on how to do so using Excel.

What is Portfolio Return?

Portfolio return measures the gain or loss of an investment portfolio over a specified period relative to the initial investment value. It is important for investors like us to evaluate our performance and compare them against benchmarks, so we can know how our portfolio actually performs and learn and improve it.

How to Calculate Portfolio Return?

There are multiple methods in calculating portfolio return. The differences in the calculation are mainly data required to calculate them and their limitations which we will lay out further below.

Holding Period Return

When you have all the gains, costs, initial value, and end value, you can calculate the return by using the Holding Period Return method.

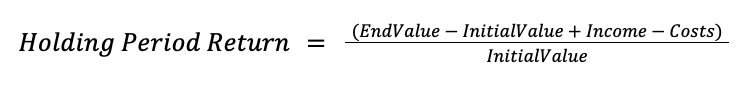

Holding Period Return Formula

The formula is quite straightforward. Holding Period Return (HPR) is percent of all the gains over the initial value of the portfolio. Gains include value appreciation of the investment plus other income net with related costs. For example, if we bought AAPL at $175, received $0.24 dividend and, at the end of the period, AAPL was valued at $200, our HPR would be (200 - 175 + 0.24) / 175 = 14.42%.

How to calculate Holding Period Return in Excel?

To calculate HPR in Excel, you can follow the instructions below:

- Input End Value, Initial Value, Income and Cost into your Excel file

- Calculate the HPR using the formula above

Weighted Average Portfolio Return

To calculate portfolio return using the weighted average portfolio return method, you will need the portfolio weight of each investment in the portfolio at the beginning of the period and their subsequent returns in the period.

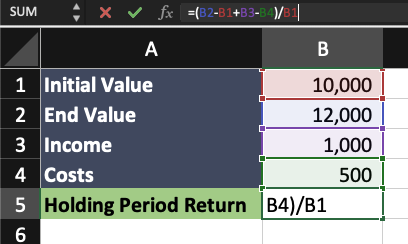

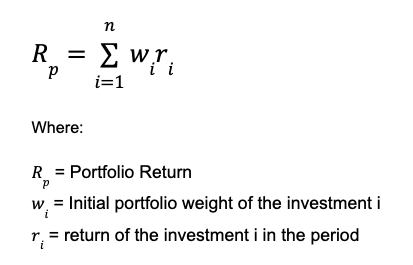

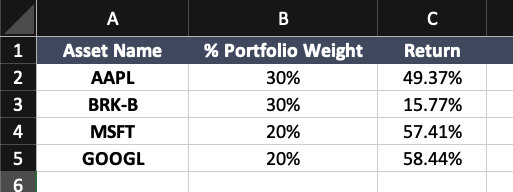

Weighted Average Portfolio Return Formula

How to calculate Weighted Average Portfolio Return in Excel?

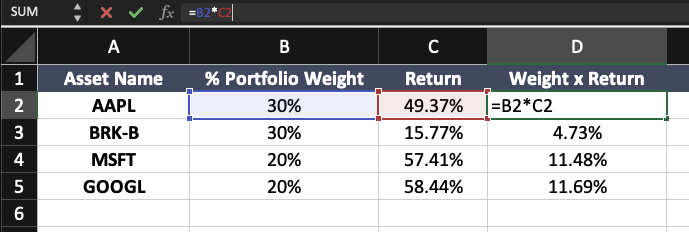

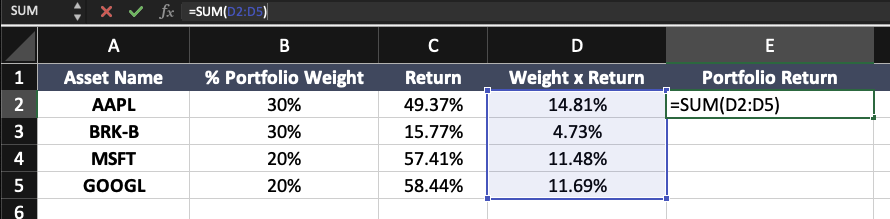

- Create the table with asset name, initial portfolio weight and return for each of them

- Multiply the weight and return of each asset to get the return impact on the portfolio

- Sum the values to get weighted average portfolio return

Time-Weighted Return

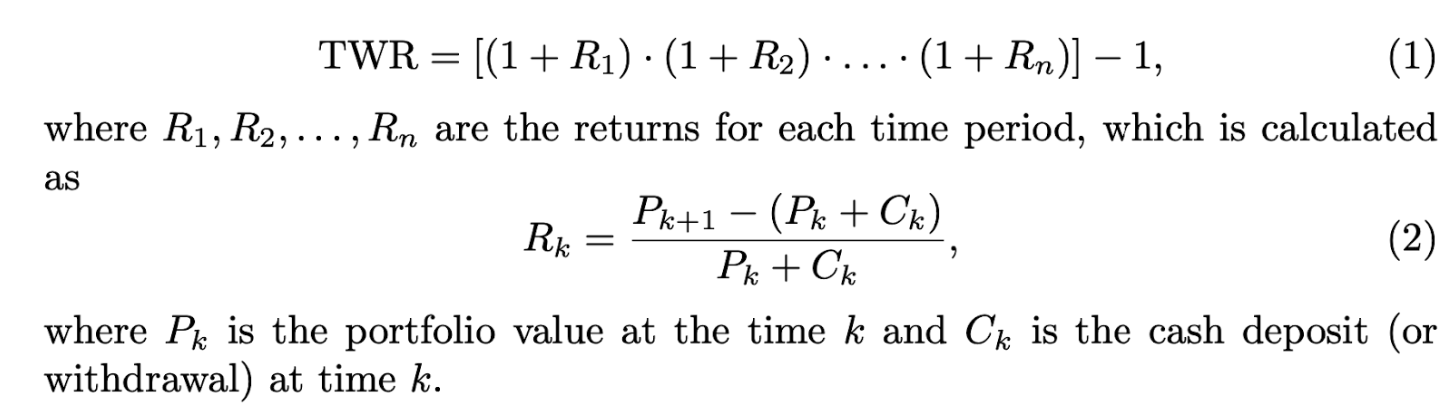

Time-weighted return (TWR) is a measure of investment performance that calculates the return for each time period separately and then combines these returns with equal weight. This means to calculate TWR, you will need the cash flow of the portfolio and its values at each time frame.

Time-Weighted Return Formula

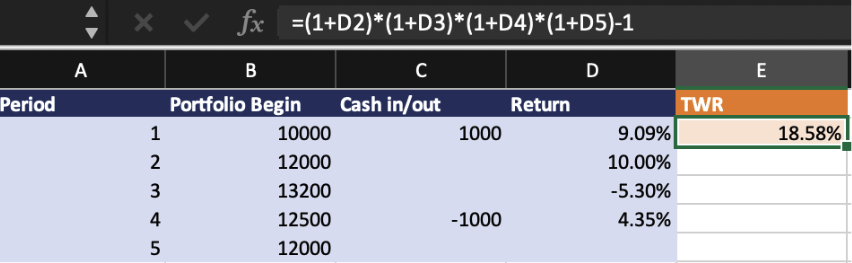

How to calculate Time-Weighted Return in Excel?

- Input the portfolio value at the start of each period and record any cash flows (inflows or outflows) during that period.

- Calculate the return for each period using the formula mentioned earlier.

- Take the one plus return and multiply all the return from all periods to obtain the TWR.

Alternatively, you can try calculating time-weighted return using our free TWR calculator.

Money-Weighted Return

Money-weighted return (MWR), also known as internal rate of return (IRR) and Dollar-Weighted Return, considers the timing and amount of cash flows in and out of the portfolio. Mathematically, Money-Weighted Return is calculated by solving for a rate of return that equates the current portfolio value to the net present value. The calculation is quite complex to do with a simple calculator, so usually it is calculated using a financial calculator or program such as Excel and Google Spreadsheet. Alternatively, you can try our free MWR calculator.

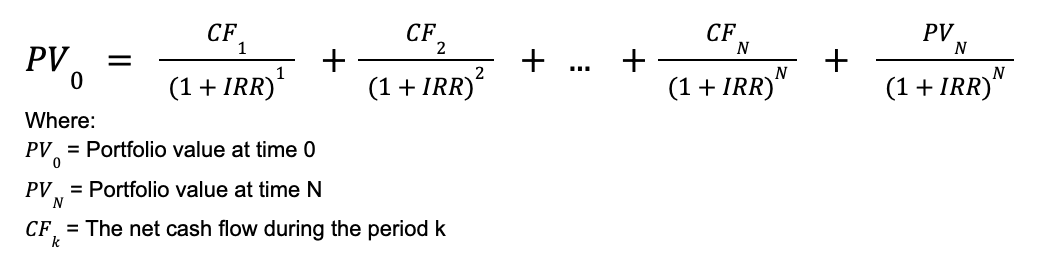

Money-Weighted Return Formula

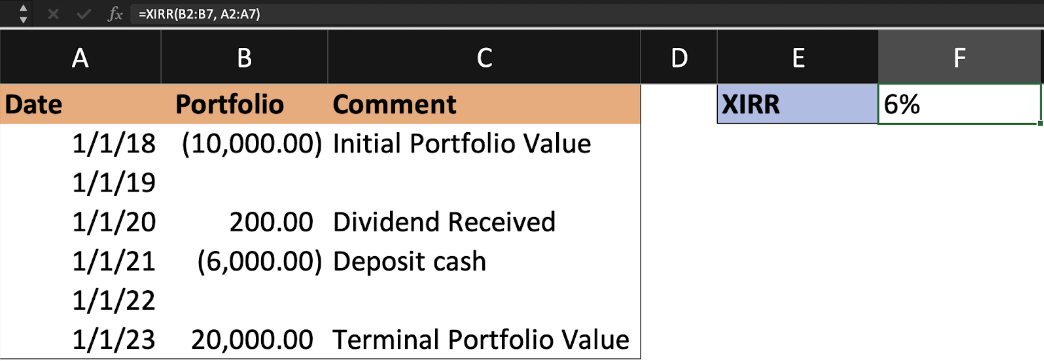

How to calculate Money-Weighted Return in Excel?

To calculate MWR in Excel, you can use the XIRR function to solve the equation above. Simply input the initial portfolio value and all related cash flows with date and size as shown below, and the function will return the MWR for you.

Measure your portfolio performance with Portseido

We know measuring portfolio performance correctly can be lots of work, so we make it easy for you. Portseido helps you measure your portfolio performance easily and effortlessly. We provide all type of return calculation from simple return, time-weighted return, and money-weighted return. We offer a range of user-friendly performance report features, including monthly report, dividend report, all with easy-to-understand visualizations to help you assess your true financial performance.