Dividend Yield - What is it? How to calculate?

Article last updated: October 16, 2023

For dividend investors, selecting good dividend-paying companies is crucial, and one of the most important metrics to evaluate these companies is the dividend yield. Dividend yield provides valuable insights into the potential return on investment through dividends. In this article, we will delve into what dividend yield is, how to calculate it, and what you should look out for when using dividend yield.

What is Dividend Yield?

Dividend yield is a financial ratio measuring dividend paid in percentage of current asset price. It is one of the fundamental metrics used by investors to quickly evaluate dividend-paying stocks. It quantifies the return an investor can expect to receive from a particular investment, assuming the dividend remains the same. In essence, it measures the annual dividend paid by a company relative to its current stock price.

This ratio helps investors gauge the rate of return they would earn if they were to purchase the company's stock at its current market price and hold it for a year, while also receiving dividends. The key assumption and important thing to note here is that this number is backward looking since it uses the past year dividend in the calculation. If you were to buy that stock now, your return would actually be the next year's annual dividend.

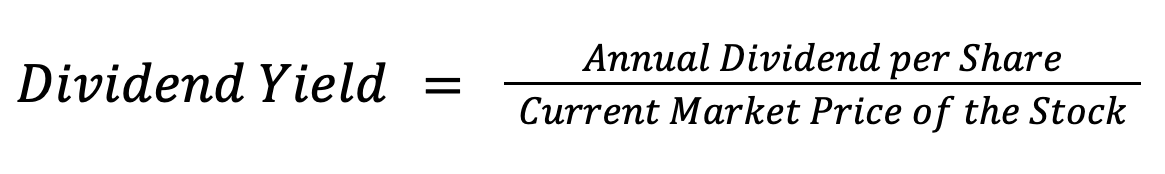

How to Calculate Dividend Yield?

The calculation of dividend yield is relatively straightforward. To determine the dividend yield of a stock, you need two pieces of information: the annual dividend per share and the current market price of the stock.

For example, if a company pays an annual dividend of $2 per share, and its stock is currently trading at $40, the dividend yield would be:

Dividend Yield = $2 / $40 = 5%

This means that if you were to buy this stock at the current price, you could expect a 5% return on your investment in the form of dividends.

Is a High Dividend Yield Good?

At first glance, a high dividend yield may seem attractive because it implies a potentially higher rate of return. However, it's essential to consider a few factors when using this metric.

Sustainability: High dividend yields are only beneficial if the company can sustain those dividend payments. You should assess the financial health of the company by looking at its profit margins, cash flow, and dividend payout ratio. A company with an unsustainable dividend may not be an ideal long-term investment and you will end up not receiving that level of yield going forward.

Investment in Growth: Companies that distribute a large portion of their profits as dividends might be underinvesting in future growth opportunities. This can impact their long-term profitability and, consequently, the sustainability of their dividends. It's important to look at the balance between dividend payments and reinvesting in the business.

Essentially, as mentioned above, dividend yield as usually shown in various dividend trackers or financial websites are backward-looking in nature as it’s calculated using the past year dividend. You need to assess the company's sustainability in terms of business, financial health to evaluate if those dividend payments will grow or at least remain the same going forward.

What's the Difference Between Dividend Yield and Yield on Cost?

Another metric that dividend investors often look at is “yield on cost”. Dividend yield and yield on cost are related but different concepts. The key difference lies in what each metric measures and the perspective it offers.

Dividend Yield: As discussed earlier, dividend yield measures the annual dividend received over the current market price. It provides an estimate of the current rate of return on your investment if you were to buy the stock at its current price.

Yield on Cost: Yield on cost, on the other hand, measures the annual dividend received over the average cost of your investment. This metric provides a long-term perspective, accounting for the gains in yield that result from dividend growth over time. It is particularly useful for long-term investors who have held a stock for a while.

Let’s look at an example. Imagine you purchased shares of a company several years ago at a price of $50 per share, and at that time, it had an annual dividend yield of 3%. Over the years, the company consistently increased its dividend payments, and now, the annual dividend per share has grown to $3.50. However, the current market price of the stock has also risen to $100 per share. In this case, the current dividend yield, calculated as $3.50 / $100, is 3.5%. This represents the return you would receive based on the current stock price. However, your yield on cost is calculated as $3.50 / $50, which is 7%. This reflects the return on your original investment of $50 per share. So, while the current dividend yield is 3.5%, the yield on cost is significantly higher at 7%, demonstrating how it measures the long-term yield growth resulting from your initial investment.

Bottom Line

Dividend yield is one of the crucial criteria for dividend investors seeking income from their investments. It offers a snapshot of the potential return on investment through dividends, assuming the dividend remains unchanged. However, it's essential to note that it’s backward looking and you should consider factors like sustainability and growth when evaluating high dividend yields. In the world of dividend investing, understanding these concepts is important to make informed investment decisions and achieve your financial goals. So, when tracking your dividends, remember that the dividend yield is just one piece of the puzzle in evaluating dividend-paying stocks and building a successful dividend portfolio.

Track Your Dividends Automatically with Portseido

We know tracking dividends can be painful and high-effort, so we make it easy for you. Portseido helps you track your dividends easily and effortlessly. We automatically keep track of your dividends and integrate them into your performance calculations. We offer a range of user-friendly dividend tracking features, including projected income, a dividend calendar, dividend yield, and yield on cost calculation, all with easy-to-understand visualizations to help you assess your true financial performance.

But that's not all – Portseido isn't limited to just dividends. We provide a comprehensive portfolio tracker that covers global stocks, ETFs, mutual funds, and cryptocurrencies. Supporting multiple currencies and the management of multiple portfolios, our platform generates powerful performance reports, in-depth analytics, and beautiful portfolio visualization, giving you a complete overview of your investments. With Portseido, tracking dividends and managing your portfolio has never been simpler.