What is Ex-Dividend Date?

Article last updated: October 21, 2023

Dividend payments are a common source of income for investors, but understanding when and how these payments are distributed is crucial for making informed investment decisions. In this article, we will explore what ex-dividend is, how it affects dividend investors, and the difference between ex-dividend date and other dividend-related dates such as record and payment dates.

What is Ex-Dividend?

The ex-dividend date is the first date on which those who buy or sell shares will not receive the upcoming dividend payment. Put simply, if you want to receive a dividend, you must own the stock before the ex-dividend date. Trading on or after this date means you won't be eligible for the next dividend payment. We also say that the stock is ex-dividned if it is traded on or after the ex-dividend date.

Will I get a dividend if I buy on the ex-date?

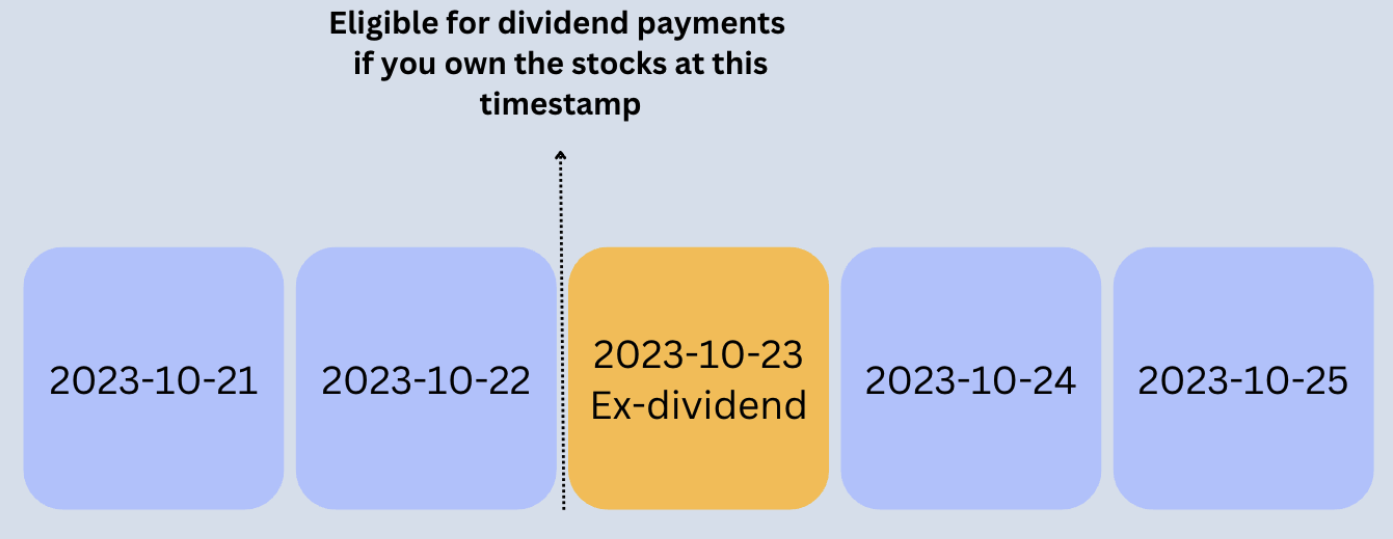

In short, no. If you purchase a stock on the ex-dividend date, you won't receive the dividend payment. You need to be the owner of the stock before the ex-dividend date to qualify. The graphic below illustrates this clearly.

Will I get a dividend if I sell on the ex-date?

Yes, If you are the stock's owner and you decide to sell it on the ex-dividend date, you will still receive the pending dividend. This concept might seem counterintuitive, as you are no longer a shareholder when the dividend comes, but it is designed to ensure proper and deterministic criteria and cutoff for who will be receiving the dividends.

Is it better to sell before the ex-dividend date?

The decision to sell before or after the ex-dividend date depends on various factors, but, typically, it will not make a substantial difference. In a well-functioning market, due to no-arbitrage opportunity, the stock price should drop by an amount equal to the dividend you're missing out on. The market should adjust for this, leaving investors in a similar financial position whether they sell before or after the ex-dividend date. However, tax circumstances for each investor might vary making the situation differ slightly for each person.

Do stocks rise after the ex-dividend date?

Contrary to what some might expect, stocks tend to fall by an amount equal to the dividend payment on the ex-dividend date. This drop in stock price is a natural adjustment to account for the company's reduced assets due to the dividend payment. Therefore, buying shares before or after the ex-dividend date often leads to nearly the same outcome.

What is the difference between Ex-dividend date, Record Date, and Payment Date?

Understanding the ex-dividend date is just one part of becoming a dividend investor. There are other essential dates related to dividend payments that investors should be aware of:

Ex-Dividend Date: As discussed, this is the date before which investors need to own a stock to be eligible for the upcoming dividend. It typically occurs a few days before the record date to allow time for settling trades.

Record Date: The record date is the day the company closes the book on who is entitled to the pending dividend. This date usually occurs a couple of days after the ex-dividend date to account for time to settle their trades from the ex-dividend date.

Payment Date: The payment date is when the company actually disburses the dividend to the entitled stockholders' accounts. This is the date when you'll see the dividend amount reflected in your brokerage cash account.

In conclusion, understanding ex-dividend dates and their relationship to record and payment dates is essential for investors seeking to maximize their returns from dividend-paying stocks. By knowing these dates, you can ensure that you will receive the dividends you are entitled to while making informed investment decisions.

Track Your Dividends Automatically with Portseido

We know tracking dividends can be painful and high-effort, so we make it easy for you. Portseido helps you track your dividends easily and effortlessly. We automatically keep track of your dividends and integrate them into your performance calculations. We offer a range of user-friendly dividend tracking features, including projected income, a dividend calendar, dividend yield, and yield on cost calculation, all with easy-to-understand visualizations to help you assess your true financial performance.

But that's not all – Portseido isn't limited to just dividends. We provide a comprehensive portfolio tracker that covers global stocks, ETFs, mutual funds, and cryptocurrencies. Supporting multiple currencies and the management of multiple portfolios, our platform generates powerful performance reports, in-depth analytics, and beautiful portfolio visualization, giving you a complete overview of your investments. With Portseido, tracking dividends and managing your portfolio has never been simpler.