Another hard part of investing

Article last updated: July 12, 2022

As an investor, I always find Howard Marks’ memo a great source of learning. For those who don’t know who Howard Marks is, he is a great value investor and cofounder of Oaktree Capital Management. Periodically he writes a short memo (also available in podcast) reflecting his views on the investment landscape. Recently I’m intrigued by one of his memos titled “Selling out”. The article discusses when to sell an investment. The part that I’m intrigued is when he quoted his son Andrew

“When you look at the chart for something that’s gone up and to the right for 20 years, think about all the times a holder would have had to convince himself not to sell.”

Then he raised an example of $AMZN whose return to date was more than 1,600x. Buying such stock over thousands of other alternatives is not easy, and, even if you have bought it, keeping such stock over the long term is still not easy too.

In this article, we dive a bit deeper, looking back into the past, and mimic what it would feel like to buy and hold such multi baggers.

AMZN historical performance

A $10,000 investment on AMZN at the close of its first trading day would be worth $16 million as of March 24th, 2022. This figure is equivalent to 166,642.85% (1,666 baggers) or 34.94% annualized return over 25 years, beating the S&P 500 (6.97% annualized return over the same period) by a light year. The chart above might look pretty (going from bottom left to the top right). However, we rarely see things. In the next part, we will zoom in a bit at each important milestone. The goal is to see and learn more from them what really happened to our simulated portfolio. To be able to truly understand what it feels like, putting all other things aside and asking yourself: would you still be able to hold such an asset under the same circumstance?

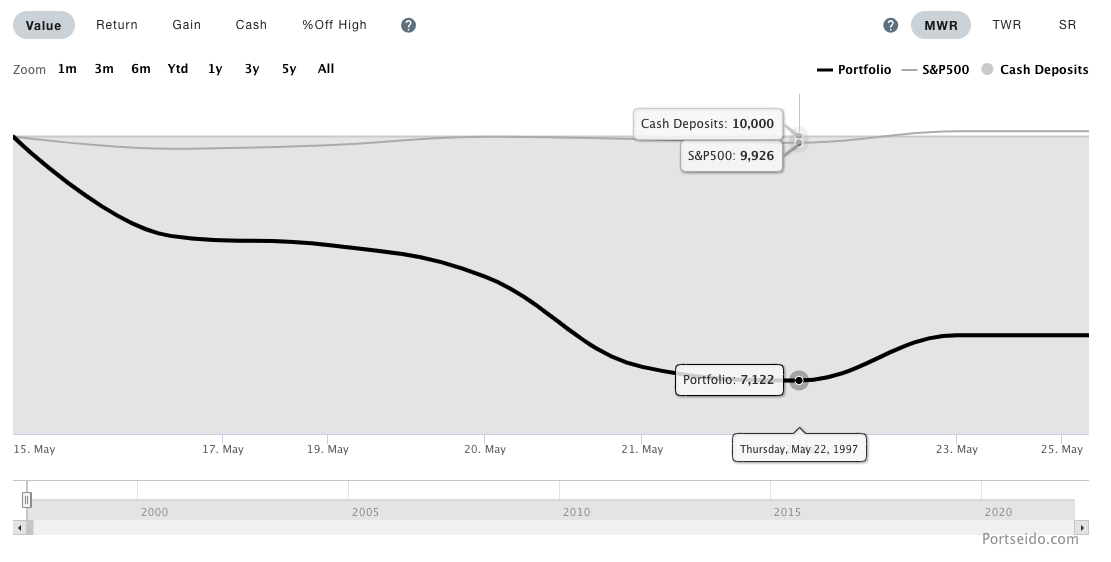

First year

1 week — Just after 7 days of buying, our investment was down -28.78% to $7,122. Great start!

2 months — After that one and a half month, our investment breaks even for the first time.

4 months — Our investment doubles

10 months — Our investment triples

1 year — Our investment turns into a 10-bagger

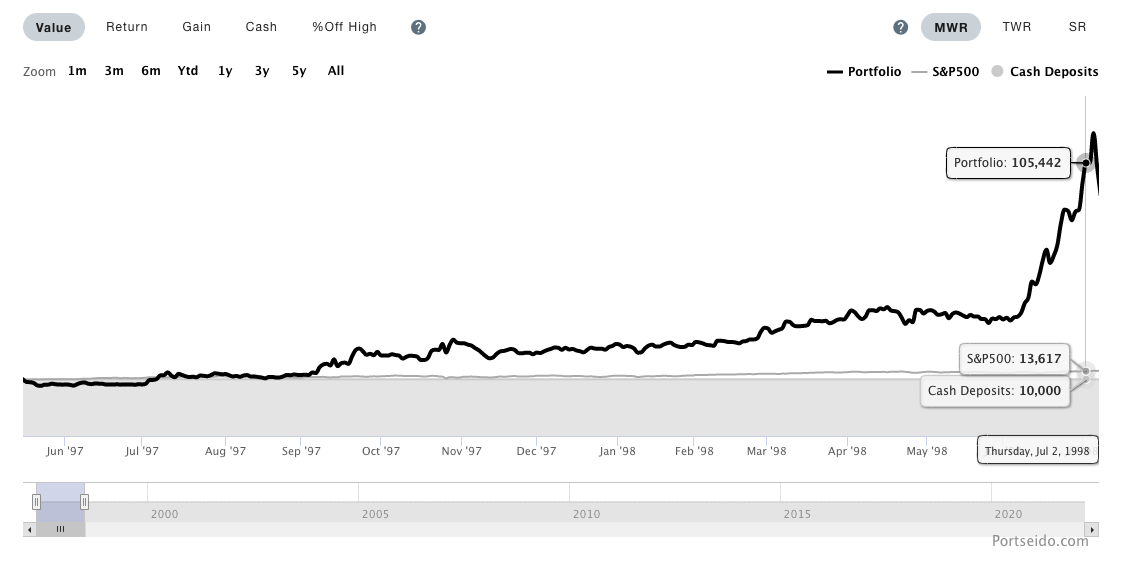

Into the bubble

1 year 4 months — Our investment was down -47.67% from its high a quarter earlier.

1 year 8 months — Our investment skyrocketed and grew 7.59 times from that huge drawdown (+4,609.82% since inception).

2 years 3 months — Our investment was down -59.31% from its peak.

2 years 8 months — Our investment reached all-time high again to $544,324 (+5,343.24% since inception). By now, we should be familiar with 40% drawdown already since it had reached that point 4 times already with each time larger than before. Largest drawdown to date was -59.31%

Dot-com bubble burst

From there, your worst nightmare happened- in less than 2 years, the investment was down 94.40% from its high. It went from $544,324 to $30,459.

8 years since its high in 1999 — our portfolio gained momentum and was back to $475,541

It took 10 full years to recover such loss (3,619 days to be precise).

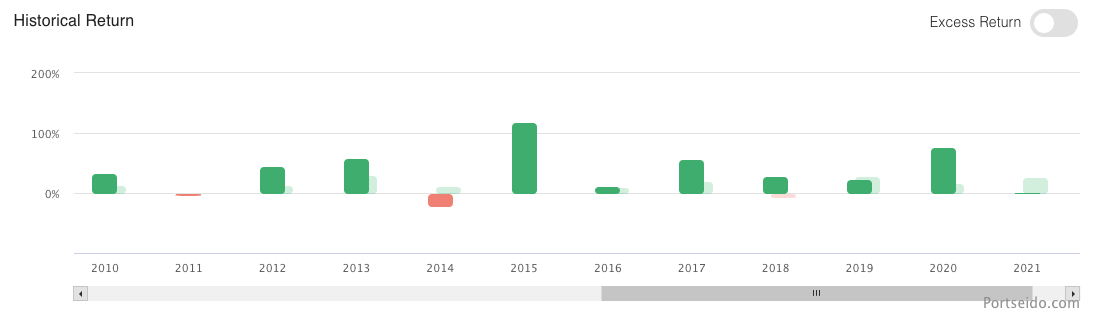

From there, 12 years passed, there were only two down years for the portfolio. During such a period, it repeated itself although it was not as extreme as in 2001. Portfolio went up, made several -30% drawdowns, recovered and repeated.

Throughout the journey, there are many points in time that make me wonder how many of all people would still be able to hold their nerve and keep holding such an investment. Buying such assets early on has been difficult, considering the fact that many $AMZN competitors had been long gone. Holding the investment after watching it double, triple and morphed into a 10-bagger or even 100-bagger might be as difficult if not more. This might be one of the overlooked aspects of investing.

Investing can be complex, but it's one where many learn and grow from experience. While mistakes are part of the journey, managing your portfolio shouldn't be one of them. That's where Portseido comes in. We've developed this tool to help you monitor your investments efficiently, empowering you to make informed decisions and work towards achieving your financial objectives.

The purpose of this article is to learn from the past investment cases. Nothing contained in this article should be construed as investment advice.