Investment Portfolio Benchmarking

Article last updated: October 31, 2023

What is a Benchmark?

In investing, a benchmark is a set of reference assets or portfolios employed to assess and compare the performance of investments. Typically, a broad market index of asset category is chosen as a benchmark because it effectively represents a comprehensive cross-section of relevant assets. This selection helps in evaluating the effectiveness of an investment by providing a standard against which its performance can be measured.

Why is portfolio benchmarking important?

One reason to consider benchmarking is opportunity cost. Opportunity cost is a benefit you forego when choosing one alternative over another. In the case of investing, when considering investing in an asset, investors always have other alternatives to invest the same capital in. As such, we can say that foregone benefit is the true cost of investing. However, comparing every decision made in investing with the next best alternative at the given time can be time consuming. Hence, most people will find that professional investors have been using various indices as a next best alternative instead.

A stock portfolio with a return of 10% might seem good. However, when compared to a benchmark which returns 20%, the portfolio’s true performance might not look so good now. Investors will be able to grade their own skill and find the performance gaps for improvement over time. By comparing to benchmarks, investors can gain more insights in their investments.

How to choose appropriate benchmarks for portfolio?

Since the goal in benchmarking the portfolio is to consider opportunity cost and to learn the most out of it, the benchmark itself should be comparable to the portfolio. What that means is, a benchmark should have a similar risk and return profile as the portfolio because this allows the investor to reflect on how much value has been added by their involvement in actively managing the capital instead of investing the same capital into similar assets. Comparing a portfolio to a benchmark with different risk levels is inappropriate because the difference in returns might be from a more conservative / aggressive risk level.

One of the common ways to match the risk and return profile is to match the asset classes. The asset classes can be as narrow as the same asset class in a specific industry of a country.

Examples of Portfolio Benchmarks

S&P500

500 leading publicly-traded companies in U.S. weighted by market capitalization

Nasdaq

3,000+ common equities listed in Nasdaq stock exchange weighted by market capitalization (Although it contains many companies in various industries, it is commonly used as an index representing tech companies since it has a high concentration of them)

NYSE

2,400+ common stocks listed in New York Stock Exchange (NYSE) weighted by free-float adjusted market capitalization (stock price times the number of shares readily available in the market)

Dow Jones Industrial Average (DJIA)

30 large well-established and financially-sound companies based on certain criteria listed in NYSE and Nasdaq weighted by price

MSCI World Index

1,500+ large and mid cap companies across 23 developed countries weighted by free-float adjusted market capitalization

QQQ

ETF that tracks 100 largest non-financial companies listed in Nasdaq (regarded as large cap growth fund)

EEM

ETF that tracks MSCI Emerging Market (large and mid cap companies across 25 emerging markets weighted by free-float adjusted market capitalization)

In addition to the popular ones mentioned above, there are still many ETFs specializing in a specific industry in a given stock market / segment. You can search for more information here.

How do you benchmark a portfolio performance?

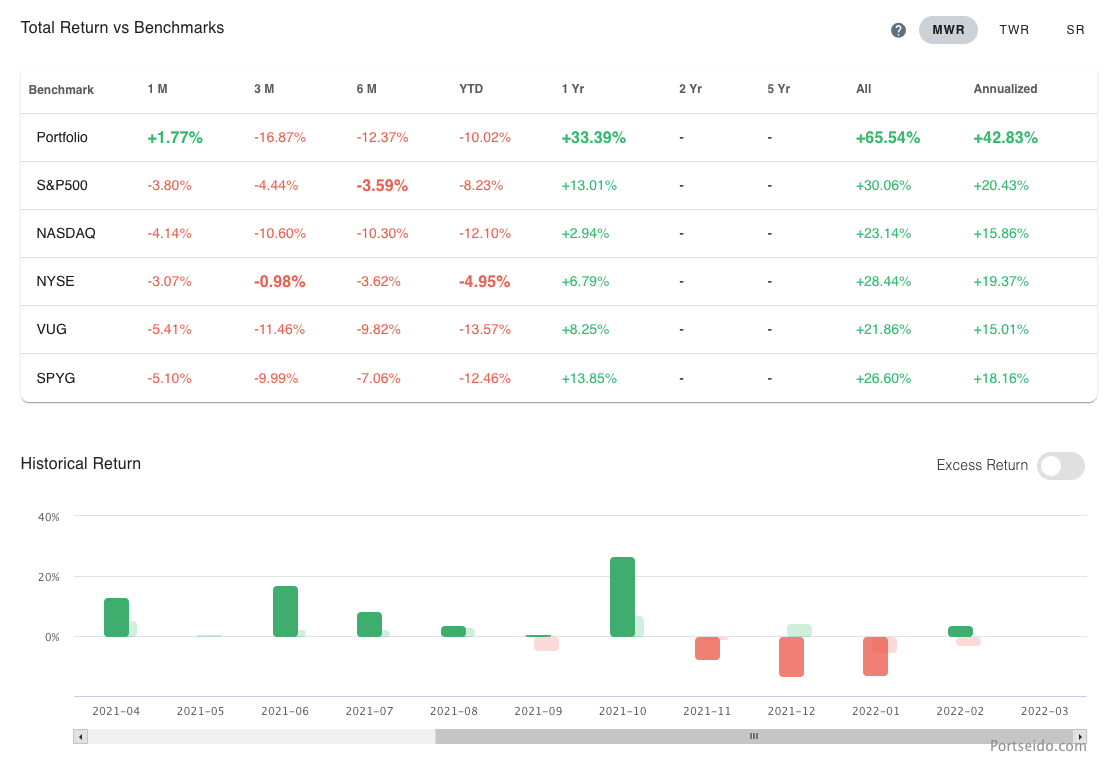

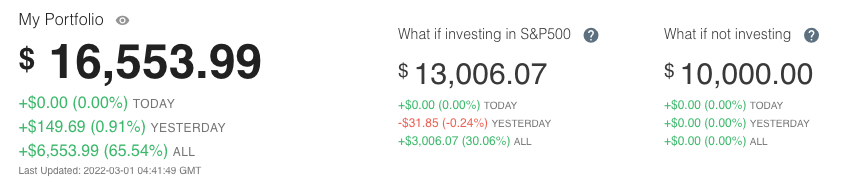

One of the most common ways to compare portfolios is to use return. Return can help tell how well investors are in actively managing the funds. In reality, return calculation can be difficult to compute for both portfolio and benchmark. We have that covered in another article here, but, in summary, calculating return can be problematic when there are multiple cash deposits to or withdraws from a portfolio, so Money-weighted return and Time-weighted return are introduced to solve such a problem.

Apart from the return, risk is another key aspect to compare. While it is great in beating the benchmark on the return side, it might not tell the whole story if that is the result of taking more risk e.g. leveraging more. There is nothing wrong in taking more risk here, but investors need to see the whole picture of their portfolios, whether the performance gap came from value added by investors themselves or the incremental risks taken. The common metrics for risk measurements are drawdown, standard deviation of investment return and Beta.

Beyond the previously discussed return and risk, there is also risk-adjusted return. Risk-adjusted return is a financial metric that evaluates the performance of assets while taking into account the level of risk involved. Recognizing that investors may be willing to accept higher risks in pursuit of greater returns, it may not be equitable to compare investments to a benchmark using return and risks alone. Examples of risk-adjusted return measures include the Sharpe ratio and the Treynor ratio.

By tracking a portfolio and comparing it to an appropriate benchmark, investors will be able to dig deeper into their own portfolios and understand more on how every decision made contributes to the end result. At Portseido, we help investors track their portfolio effortlessly and answer some of the most important questions in investing. How does your portfolio fare against a benchmark in the bull/bear market? Which decisions helped beat the benchmark? Where did the gains come from? And many more…